One of the most important things that anyone can do when getting started on their investing journey is to focus on the small “wins.” Just as Dave Ramsey recommends the Snowball method to create momentum in paying off debt, building momentum in saving money is incredibly motivating, and that’s why I highly recommend anyone implement these 23 simple steps to save money on groceries!

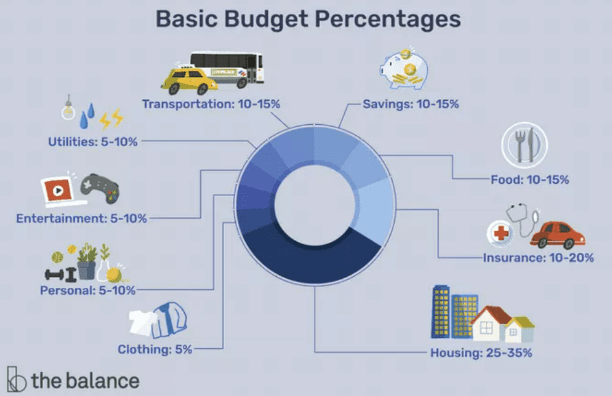

According to The Balance, you should expect to spend about 10-15% of your income each month on food:

How To Save Money on Groceries

At first thought, that might seem like an extremely high amount, but I’d be willing to bet if you want back and checked your finances, you’d see a similar amount of spending – or maybe even more!

Some people will track their food budget in various groups such as “groceries” and “restaurants,” but I like to group them. If you break them up and decide to try to eat at home more often, it will look like your grocery budget is going up and potentially cause concern, but this is a great thing and is expected!

If you cook at home, you can eat very healthy meals for under $3/plate but going out to eat you can easily spend $10+ before adding in a nice tip! For that reason, I think it’s best to group them all under one comprehensive “food” budget line.

So, how can you save money on your “food” budget?

1. Have a Grocery List and Stick to It

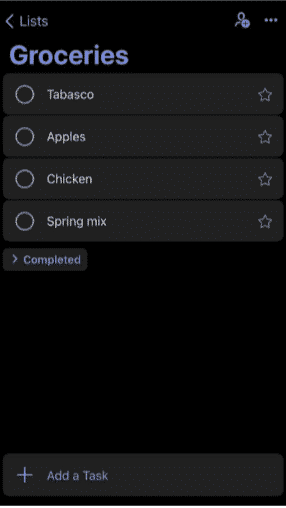

Having a grocery list is probably the most important of these methods. If you stick to your list, then you’re going to have zero unanticipated expenses. I use a to-do list app on my phone, but some apps were made literally for a grocery list.

Another benefit is that if you use an app to do this, it’s on your phone, so you always have the list of the items that you need. As I’m writing this, I thought, “Andy, you’re almost out of Tabasco sauce – put that on the list”.

Before you ask, yes, Tabasco is a staple in my life.

2. Shop the Perimeter of the Store

Shopping the store’s perimeter means avoiding the aisles as much as you can. In other words, you’re going to be buying fresh meat, fresh fruits, fresh vegetables, and fresh dairy.

Now, there are some items in the aisles that I’m ok with buying, such as canned goods, pasta, grains, etc., but I try to limit those items to still healthy ingredients and nothing processed.

3. Avoid the Name Brands

Name brands honestly are such a scam. You’re paying for a brand, and that’s it. You can’t tell the difference in quality, and if you say you can, you’re lying.

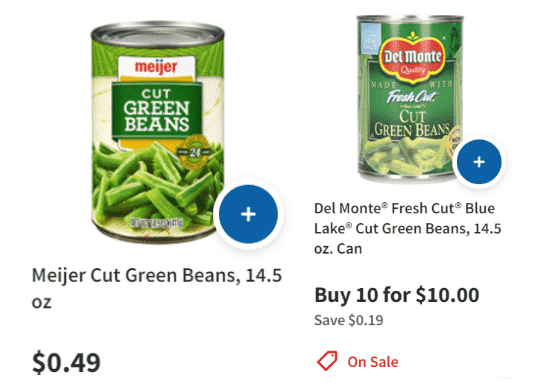

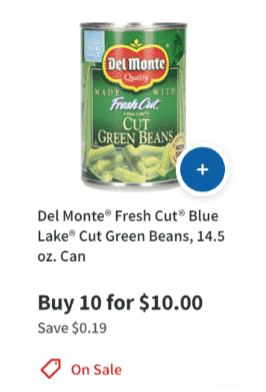

Even something as simple as green beans, per the store that I always shop at, Meijer, you can get the Meijer brand for $.49/can or the name brand kind that is on sale for $1/can:

I know we’re only talking about $.51 here for a difference, but that’s a big deal. My family probably goes through about four cans of green beans each week, so you’re talking $2/week or $104/year. And when you save this $2/week, take that money and immediately throw it into the market because even small amounts add up to significant investments!

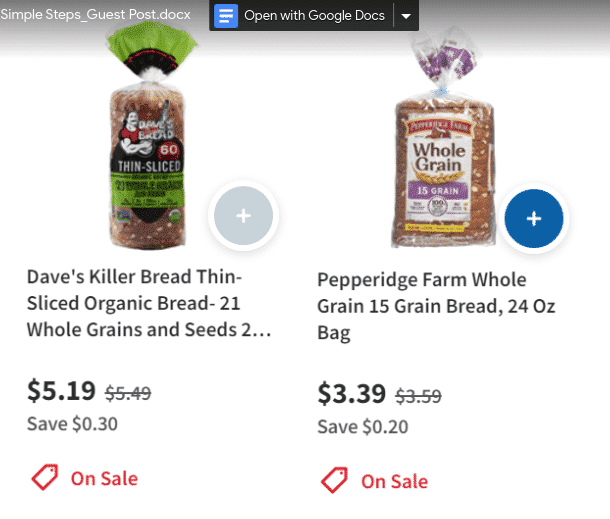

This applies to a ton of items. Below are two brands of bread that are nearly identical, yet one is $2/loaf cheaper:

Not to mention, the Pepperidge Farm bread is even 3oz more bread, so the unit cost is even lower, and the savings are even more! This takes me to my next point.

4. Understand Unit Pricing

This is a grocery shopping MUST. It’s imperative to know how to calculate unit costs with items. Many stores will have the unit cost on the price tag, but not all will, or maybe the units vary slightly. You must compare them to make sure you’re comparing apples to apples.

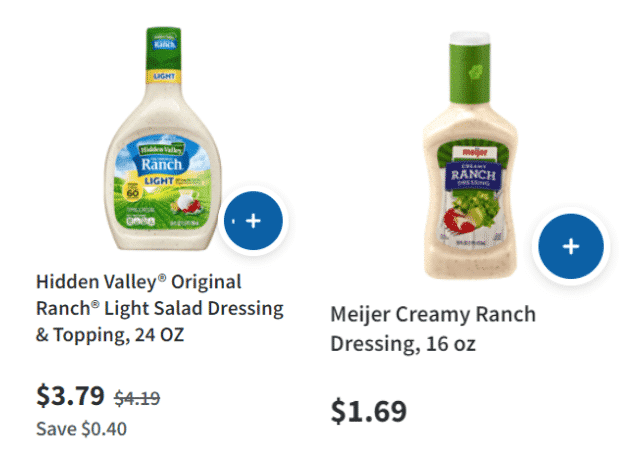

Oh, you want to buy some ranch. Look, Hidden Valley is on sale!

You have to get the Hidden Valley, right? WRONG!

Hidden Valley: $3.79/24oz = $.16/oz

Meijer Brand: $1.69/16oz = $.11/oz

Just because the Hidden Valley is on sale doesn’t mean you should get it. You’re still better off buying the Meijer brand in this situation, but you only knew this because you calculated the unit costs. And now that we have calculators on our phones, there’s no excuse not to be able to do this!

5. Find Out When Your Store Gets Restocked

You don’t have to be James Bond to do some 007 undercover work here but instead, ask an employee when they get their trucks in. Or, if you’re too shy to do that, then you can track the days that you go there and when you see people restocking shelves. It’s obvious when you see it.

Why does this matter? Well, it matters if you’re shopping the store’s perimeter because of all that fresh stuff. So yeah, it’s got to go!

The store will discount their fresh items, which is a buying opportunity for you! So stock up on some of those items, even if you don’t need them, and throw them in your freezer. I always will do this

because Meijer throws a 20% off sticker on their steaks and pork, so I’ll buy 4-5 pounds and stash them away for when I need them in the future.

6. Don’t be a Store Snob

“I only shop at Whole Foods because I like to feel fancy.”

That’s great – good for you! I only shop at Meijer, Kroger, Walmart, Aldi, and Amazon because I like MONEY! I take the time to find what items are the cheapest at what stores and will purchase there. I won’t sacrifice quality, but packaged goods like cheeses, yogurts, milk, rice, etc. are typically cheaper at Walmart. Fresh items are cheaper at Aldi. Household goods are cheaper on Amazon. And I go to Meijer for any specials or more unique items/selections.

I recently found that the beef we buy is $2.50 cheaper than the beef at Meijer. So, for me to take a couple of extra minutes out of my day and drive across the street, I can buy 5 lbs. of beef and throw it in the freezer and save $12.50!

Don’t be a snob – find the stores that work for you!

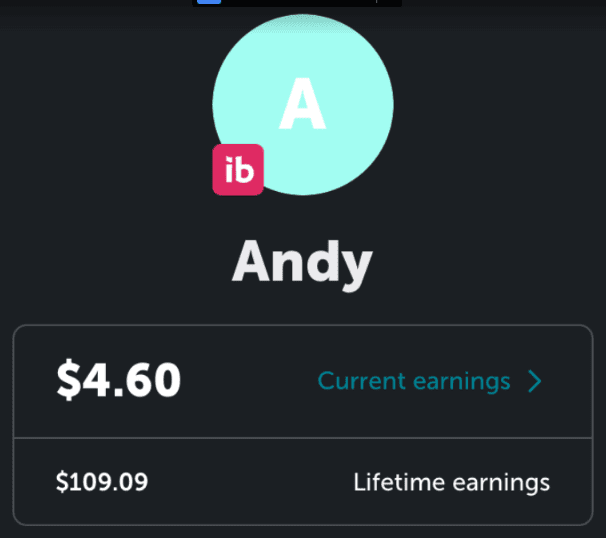

7. Use Ibotta

Ibotta is a great coupon app to use. Many weeks I’ll only get $.10 or $.20 back, so effectively nothing, but sometimes, I’ve found myself getting $5-$10 back because I’ve had to buy diapers and a few other items on promotion. It takes me about 5 minutes every Sunday morning before I go to the store, and I’ve saved nearly $110 in total:

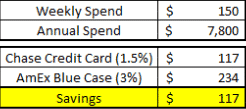

8. Use the Right Credit Cards

If you’re paying off your credit card, always use a credit card when buying groceries. It might seem minuscule, but my American Express Blue Cash card gets me 3% back on groceries. Well, remember how 20% of our spending is on groceries? Saving 3% means that I just increased my savings rate by nearly 1%. That’s a huge deal!

Over a year, assuming our regular spending of $150/week (and honestly, that’s probably on the low end), simply by using my AmEx card, we’re saving an extra $117 in credit card rewards:

Now, this card is one that I already had opened back from when I was in college, but seeing that this card has no fee, I could be enticed to open it simply for the grocery aspect. If you’ve taken time to build excellent credit, using that credit to utilize credit card rewards can be an excellent method if you’re paying the entire card off!

Every. Single. Month.

9. Meal Prep

The fewer people in your family, the more important this is. It’s hard to cook for one, a little easier for 2, easier for 3, and so on. If you can meal prep and embrace the leftovers, you’re going to be able to not worry about having to throw out extra food.

You must plan. It’s an absolute must. And the more you can meal prep with recipes, the more you’re going to be able to intuitively prep your food and make sure you’re buying the perfectly sized quantities and minimizing food spoiling!

Start next week off with having defined meals every day! For example, we cook on Monday and have those leftovers Tuesday, then cook Wednesday and have leftovers Thursday. Then we will cook a newly meal Friday and Sunday and likely order pizza or takeout on Saturday. We have a plan, and it works for us – you must find yours!

10. Sign up for the Loyalty Program

Almost all stores have a loyalty program, from my experience, and they can be significant. I don’t like to call these “savings” because all the stores are doing is marking up items and then recouping them with these loyalty programs, but not being enrolled in them are costly.

Meijer gives us $8 for every $400 spent, so while that’s not some massive amount of savings, it is 2% cashback.

11. Look at the Sales

Every Sunday, when creating a meal plan with my wife, the first thing that I do is to look and see what’s on sale. This week, for instance, we decided to go with Pork Tenderloin because it was bought one, get one free (which we froze the free one), and Egg Roll in a Bowl because the vegetables were half price.

Sometimes, infrequently, there aren’t deals, so we create our own by visiting the freezer of savings where we’ve bought all the previous sale items!

12. Have Cheap Weeks

This is one of my favorite things to do. Now and then, my wife and I challenge each other to spend as little as humanly possible. So we open the pantry and start getting creative. You can find some crazy items in your pantry that you forgot about. Throw some rice, canned green beans, and a frozen pork tenderloin together, and you have a solid meal that didn’t require you even to step foot in a grocery store.

Just try this once a month and track your progress – I guarantee you’ll at least have fun, and if you can even save $25/month, that $25 will be worth $250 in 30 years if you choose to invest it, which you should!

13. Check out the Farmers Markets

Farmers’ markets are notorious for having cheap items when they’re in season, and they’re the definition of exceptional freshness. Also, they’re fun to go to, and it’s nice to support your local community.

You must make sure you can say ‘no’ to all the delicious home-baked goods!

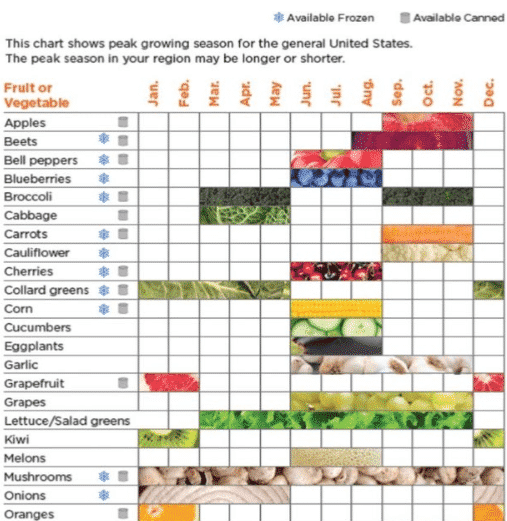

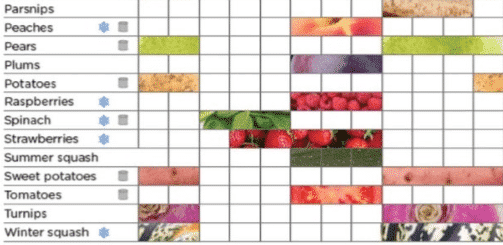

14. Know What’s in Season

Knowing what’s in season is imperative in creating your meal plan. If you know what’s in season, you can already have a generic template for meals in mind, so as soon as you see that the pork tenderloin is on sale, in your mind, you go, “I know asparagus is in season, so let’s do that,” and you don’t even have to price shop.

Here’s a link to a great guide to help you out:

15. Limit Your Trips to the Store

Only let yourself go to a store once. The more you go, the less it means to have a grocery list because you can go back the next day. Going to the store day-after-day implies that you have that much greater chance of buying something off your list and spending money you didn’t have to spend.

If you forget your Tabasco sauce like I did, guess what? No Tabasco sauce that week.

Forgot your sweet potatoes? Better find a different carb or maybe do double vegetables. Set a limit on the number of trips to the store and be firm.

16. Have your Cheap “Staples”

Always make sure you have those “staples” in your home. Staples are a necessity of your diet in the sense that they keep the diet together – things that are versatile and can go with almost anything.

For us, this means plenty of canned vegetables, rice, pasta, pasta sauce, and frozen meats. If we have those, we can always scrounge together some dinner. Sure, it might not be the most delicious meal, but it’s a cheap meal and will keep us from eating out for $30+.

17. Buy in Bulk

Going along with understanding unit cost, do not be afraid to buy in bulk. Buying in bulk is one of the best things that you can do to take advantage of deals and allow yourself less of a chance to run out of items.

About five years ago, my wife and I lived in an 800 sq ft apartment in Chicago, and I bought 96 rolls of toilet paper on Amazon. When she asked me what I was doing, I told her that I saved $.25/roll or $24 by purchasing in bulk.

Her response back to me is that I am not allowed to post here, but let’s say I’m lucky to still be with her. So, yes, always buy in bulk – but make sure you have a place to put those goods, and all involved parties are onboard!

18. Don’t Be Lazy

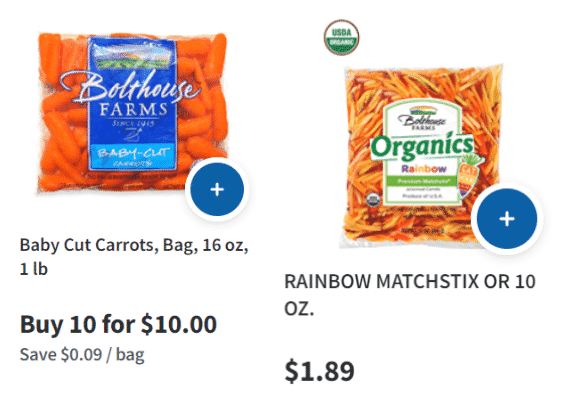

Don’t buy convenience items. This can be anything from the premade salads and rotisserie chickens to peeled onions & sliced carrots.

Yes, I do literally slice our carrots. I can buy a 16oz bag of baby carrots for $1 or a 10oz bag of sliced carrots for $1.79.

So, that’s $.06/oz or $.18/oz; easy choice. Sure, it takes a little more work, but these are the things that I am willing to do to cut down that grocery budget.

19. Don’t Drink Your Calories or Your Dollars

Don’t drink pop, don’t drink juice, or do any of that. Just stick with water. Your body and your wallet will thank you.

Now, I am a bit of a hypocrite here because I will spend a decent amount of money on nice beer, so it’s about finding a balance and what is important to you.

In the words of Ramit Sethi, “Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

20. Learn to Love Chicken

Chicken is the cheapest meat that I have been able to find, by far. I can get it for $2/lb. And sometimes even more affordable than that! The regular beef we buy, which is 96/4, is over $8/lb. (thanks, inflation) and the nutrition is similar.

So, when we buy beef, we choose that taste over $6/lb. Is it worth it? Maybe, depending on the meal, but maybe not. But, on the other hand, every time we pick chicken, we save $6, and that’s $6 closer to FI!

21. Read the Sales Fine Print

You might see a sale that says, “2 for $3” and think you need to buy two of those items. Well, you might not. Many times, the price tag will also say “$1.50 each” on it, so you know that you don’t have to buy 2 of them.

You know some of these grocery item pictures that I’ve included that say, “Buy $10 for $10?”

Well, Meijer runs these sales across many different items, and it makes you think that you must buy 10 items to get that discounted price, but you don’t. All you get is a free 11th item, but you might get sucked into buying things you didn’t need if you didn’t realize you get every item for $1.

If you have the room to store the items and they’re not going to spoil (like a canned good), then feel free to stock up on these ten items, but know that you don’t have to.

22. Race Yourself

Give yourself a specific time limit in the store. Let’s say 15 minutes. You have 15 minutes to get in and be done shopping, and if you’re not done, too bad. The faster that you’re moving, the less time you must be able to browse and make unnecessary purchases.

23. Have Freezer Space

Either in your fridge or by purchasing a chest freezer, this is important in your grocery journey. We bought a chest freezer recently from Wayfair for under $150, and it’s paid itself off in deals within a year of owning it.

You can buy used ones on Craigslist or at an auction for considerably cheaper as well. So take some time to find a great deal and pounce. It will save you money.

Simple Steps to Save Money on Groceries

Hopefully, these 23 tips will help you get started slashing your grocery budget, like today. None of these alone are going to get you to FI by any means, but grocery shopping is all about finding as many ways as possible to tip the scales in your favor.

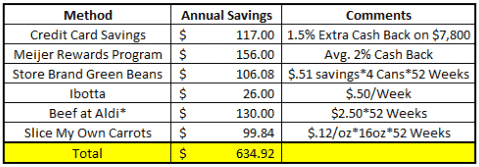

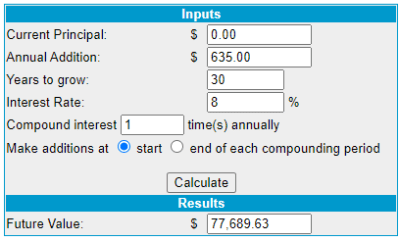

By utilizing only the six that I’ve listed below, we’re able to save nearly $635/year on groceries:

Again, $635 might not seem like much, but it can quickly add up. Throw that money into an ETF and just let it work for you, and in 30 years, you’ll be well over $77K!

Which ETF, you ask? Well, my personal favorite is MTUM, but that’s for another day!