One of the myths about having a good credit score is that you must carry a balance on your debt every month. This is not true. If you read on, you’ll learn more about how we maintain an 800 credit score despite being completely debt-free for two years.

Our family followed the Dave Ramsey approach to becoming debt-free. Overall, I like his baby steps toward achieving financial freedom. However, I don’t love all of his tactics. One tactic I don’t like and think is dangerous is that you don’t need a credit score. Eventually, you will lose your credit score if you stop using debt completely after becoming debt-free.

Ignoring your credit score seems silly to me in this day and age. Not having a credit score can prevent someone from getting a reasonable mortgage rate or a job. In addition, more companies are running credit checks on new employees. And while not having a credit score hopefully won’t keep someone from getting a job, it could factor into the decision and raise suspicion. Cell phone carriers or utility companies may also run a credit check to determine if a deposit is needed.

These examples don’t even include the obvious of applying for an auto loan or credit card. (Hopefully, you won’t need to apply for an auto loan if you are already debt-free, but you never know.) Whether you are entirely debt-free or just starting your financial journey, having an excellent credit score will benefit several areas of life.

How We Built an 800 Credit Score

About 15 years ago, I completed my undergraduate degree and was ready to take on the world. Now living on my own, trying to cut the financial cord from my parents, I realized that I needed to start building credit. But, as you may know, it can be challenging to develop new credit when you have none.

My first credit card was a company card from Circuit City. My parents co-signed, and I bought a $1,200 television on credit. Financing a tv isn’t the best idea, but I didn’t know better then. I don’t recommend financing a television to build your credit, but it was a start in my case.

My next step was to open a credit card at my bank. Once I had established some credit, my bank gave me a card with a $500 credit limit. I used this card exclusively for buying gas for my car for about two or three years.

We eventually moved on to finance a car, get a mortgage, and expand the use of my credit cards. My wife ended up with about $50,000 in student loan debt, so by 2011, we were in six-figure debt with little savings. We were paying all kinds of bills to pay back our debt.

Creditors loved us because we had a lot of debt and were good at paying it back. The 800 plus credit score built up over time by paying our bills timely, keeping our revolving debt low, and having several sources of credit. Ultimately, this is how you build a high credit score.

How We Maintain an 800 Credit Score

Improving your credit score is relatively simple. Don’t miss any payments, keep your card balance low relative to overall credit, and show a history of paying your debts.

Despite making a few foolish financial decisions, we never missed a payment on our debts. Paying on time is critical to maintaining an 800 credit score.

Once we made the last payment on our mortgage in 2018, we became completely debt-free. One of the myths about having an 800 credit score is that you need to have a revolving debt to keep your score up. That is not true. However, you must show a continued record of paying back debt even when you don’t have any. So how do you do this?

We’ve done this by continuing to use our credit cards and paying them off at the end of every month. Using and paying off our credit cards allows us to avoid revolving debt while maintaining an 800 credit score.

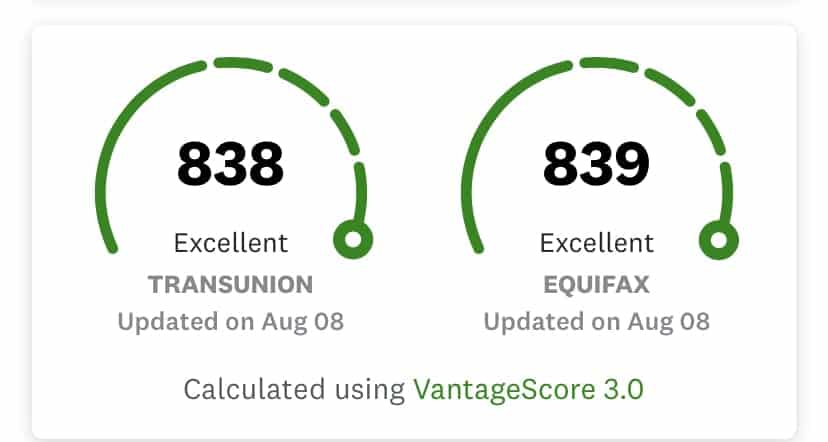

Not rocket science, I know. But, all it takes is monthly spending on your credit card to maintain an 800 credit score after becoming debt-free. It’s as simple as that. Our credit score is around 840 despite not having revolving debt. So, if someone tells you that you NEED to carry revolving debt to keep your 800 credit score, you should know that is not true.

I know that, technically, we are still using debt. However, we rarely let it carry over from month to month. If you are completely debt-free and stop using all debt, your almost perfect credit score will eventually disappear. As noted earlier, I would not recommend this approach. Anyone able to become debt-free should hopefully be able to use credit cards responsibly.

My Take on Credit Cards in General

I’ll close by saying this about credit cards: they are a tool that can benefit users. Some examples are convenience, cashback, travel reward bonuses used in emergencies, and the ability to build a credit score. On the other hand, credit cards can be a financial disaster for many families. The double-digit interest rates that come with many cards can be crippling. The stats show that many credit card holders carry a balance and pay a high-interest rate.

While someone who is debt-free may use credit cards responsibly, many others cannot. Credit cards can create a vicious spiral for those deep in consumer debt. Double-digit interest rates can keep you swimming upstream against those payments for a long time. Some people may need a credit card for emergencies, but be careful not to overuse it if you are still on the debt pay-down journey.

In the end, you have to know yourself when it comes to credit cards. If the urge to overspend is there, then get rid of them. Double-digit interest payments for an 800 credit score are not worth it.

800 Credit Score Benefits

Having an 800 credit score or higher is a bit of a vanity metric. There isn’t much additional benefit once your credit score gets above 720 or so. That said, having a high credit score does come with perks.

First, someone with an excellent credit score will be eligible for the best interest rates. A credit score over 800 means you have a track record of successfully paying back your debt on time, which lowers the risk of lending to you.

You may also be eligible for credit cards with better cashback or reward options. Playing the credit card rewards game can be dangerous if you don’t pay off your cards every month, but there are excellent benefits if you happen to be in the small percentage of people disciplined enough to do so.

An 800 Credit Score without Debt

Having an 800 credit score is not overly complicated. Like many things with personal finance, the concepts are simple, but the doing can be challenging.

To have an 800+ credit score, the absolute best thing you can do is pay your bills on time, every time. Of course, other factors are at play, such as credit card utilization (how much-approved credit you use), length of credit and payment history, total accounts, and several hard inquiries. However, if you pay your bills on time, then more than likely, you’ll have an exceptional credit score.

If you are doing these things, but your credit score remains low, there’s also the possibility of fraud or a mistake. You can visit annualcreditreport.com to request a free copy of your credit reports. Under federal law, you can get a free credit report from each credit bureau once every 12 months. Annualcreditreport.com is the only authorized source for a free credit report.

More From Financial Pilgrimage

- 3 Key Lessons Learned From the Last Recession

- Experts Explain Hyperinflation and 8 Ways to Prepare and Protect Your Money

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

We haven’t owed a penny to anyone in over a decade. Paid for house, we buy cars with cash and for our entire 42 years of marriage we never failed to pay our credit cards off in full every month. Our credit score sits right at 820 all the time. We can back up everything you’ve said in this post!

It really is a simple concept that often gets misrepresented. Thanks for reading and commenting!

I totally agree, I think you should strive to be debt free with a credit score. I plan on paying off my jeep next week and I plan on keeping my 795 credit score.