If you’ve ever had a 30-year mortgage, you may remember the feeling of opening your first bill. We had a relatively low interest rate historically at 6% though that seems ridiculously high in this age of low interest rates. So why were so many of our hard-earned dollars going to interest, insurance, and taxes? Only a tiny fraction went to pay down the actual mortgage. That first bill felt like a gut punch. How would we ever get it paid off?

My wife and I purchased our home in December 2008. Yes, that 2008, during the financial crisis. I remember sitting back and watching interest rates go haywire. Around the time we were looking to take out our 30-year loan, interest rates were approaching 7 percent.

We were able to hold off a bit, and when the interest rate on a 30 year fixed mortgage dropped to 6 percent, we locked it in. Then, within five years, we refinanced twice. First to a 5 percent rate, then eventually to 4 percent. On the second refinance, we also increased the total amount of the original mortgage by about $25,000 as we lumped in our remaining student loans.

Five years after moving into our home, we had refinanced twice, paid thousands of dollars in mortgage payments without building hardly any new equity, and then added tens of thousands of dollars in student loan debt during our final refinance.

We were making barely any progress. After the second refinance, the balance on our mortgage was $123,000 in 2012. It felt like we were treading water, and it certainly didn’t help that we piled onto our mortgage debt during the second refinance. If we made minimum payments since taking out the loan in 2012, we’d still have nearly six figures left on the mortgage today. The reality is that we hardly make any progress towards paying down a 30-year mortgage making minimal payments until the second half of the loan.

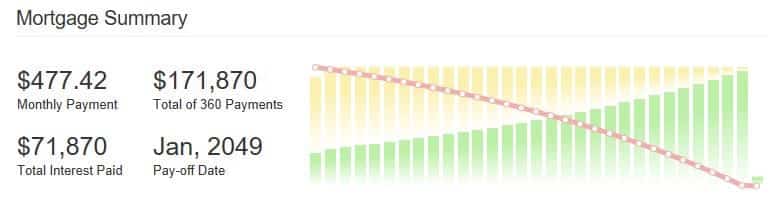

Please note that most of this post assumes a 4% interest rate on a $100,000, 30-year mortgage to keep the numbers consistent and straightforward. As of updating this post in April 2022, interest rates are approaching 5%. Interest rates change daily, and nobody knows what rates will look like in a few months.

How Much Interest Will You Pay During the First Years of a 30 Year Mortgage?

Lately, I’ve been doing a lot of research on the 30 year fixed mortgage to understand better its mechanics and the benefits of paying it off early. I’ve been trying to understand the early years of a 30 year fixed mortgage.

Even with a historically low interest rate of 4 percent, why does the majority of our payment in the first few years go towards interest? The answer is quite simple, but something still seems off.

Throughout this post, we will primarily use a mortgage of $100,000 and an interest rate of 4 percent on a 30 year fixed mortgage.

During your first year on a 30 year fixed mortgage, nearly 70% of your mortgage payment of $477 will go to interest alone. Keep in mind this doesn’t include taxes or insurance, which are typically included as escrow in your mortgage payment as well.

Therefore, even in a period of historically low interest rates, we are still paying interest for several years of a 30 year fixed mortgage. If you took out a loan today, it would take you until 2033 to reach the tipping point of paying more principal than interest in a month. You wouldn’t have half of your mortgage paid down until 2039. These numbers get worse at higher interest rates.

Even more eye-opening, since so little of your initial mortgage payments go towards the principal, it would take you nearly seven years to pay down the first $10,000 on a $100,000 mortgage at 4 percent! If you have a higher mortgage of say $500,000, these ratios pretty much stay the same.

If you don’t want to read through the rest of the article, the TL;DR (too long, didn’t read) is the math still says to invest instead of pay off your mortgage. However, if you’re like me, paying more than 50 percent of my monthly payment to interest was unacceptable, and I wanted to tip the scale as soon as possible. Below are a few additional thoughts.

Is a Mortgage Compound or Simple Interest?

Thinking through this a bit more, this raised an interesting question. Is interest on a mortgage compound or simple interest?

- Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest.

I’ll be honest; before researching this article, if you would have asked me this question, I probably would have said compound interest.

While it feels like interest is reverse compounding when nearly 70 percent of your payments are going toward interest in year one, a mortgage is simple interest usually calculated monthly. For example, the table below shows that interest is based on a simple balance calculation. First, take the mortgage balance and multiply by 4 percent (then divide by 12) for the monthly total.

Interest and Principal Paid in Year one of a Fixed 30 Year Mortgage

It takes so long to make progress in paying down your mortgage because your principal payment is spread out over such a long period. As you can see in the table above, when you pay nearly $500 per month (not including taxes and insurance), it barely puts a dent in the initial principal. Therefore, you’ll be paying almost the same amount in interest the following year.

Now once you get to the back end of your 30-year mortgage, things start to look better. At this point, you’re paying more principal than the interest, which causes the interest you pay in the following year to decrease more significantly. As mentioned above, it takes almost 15 years with a 4 percent 30-year fixed mortgage to where more of your money goes to the principal than interest payments.

How Long Do People Keep Their Mortgage?

I wondered next is how many people make it through 15 years of a 30-year mortgage? A lot can happen in those 15 years.

Many families will move to a new house and start over with a brand new 30-year mortgage, paying a high percentage of interest again for years. Some will refinance the mortgage in their current home. Others may have financial issues and go bankrupt or lose a home due to foreclosure.

Over the past several years, mortgage tenure has increased from about six years to 10 years. Locked into historically low interest rates, homeowners are less likely to refinance a new mortgage. They may also not be able to upgrade to a new home with a higher interest rate.

Regardless, suppose the average mortgage tenure is only ten years. In that case, that means the average person isn’t getting to the 15-year tipping point where they finally start paying more principal than interest. So even the overachievers who pay their mortgage early wouldn’t significantly increase this average.

The Case for a 15 Year Fixed Mortgage

Now let’s go back to that first bank statement we received after making our first mortgage payment. Our total mortgage payment was around $900, including putting money in escrow for insurance and taxes.

My jaw about hit the floor when I looked at the breakdown. It was roughly:

- $500 in interest

- $200 in property taxes

- $100 in insurance

- $100 in principal paydown

I had just made a $900 payment, and barely a tenth went to building equity. I then pulled out the amortization schedule and was horrified to see that if we made minimal payments, it would take us nearly seven years to build $10,000 in equity. That was insane to me. To the above point, if families are moving and starting over after 6 to 10 years, a family that moves two times and gets a new 30-year mortgage will have to repeat this process over and over again.

Two significant benefits to a 15-year mortgage

If a family can afford it, I recommend a 15-year mortgage. Of course, you would be giving up some payment flexibility of a 30-year mortgage, but there are many benefits of a 15-year mortgage.

First, interest rates are usually nearly a whole percentage point lower on a 15 year fixed mortgage than a 30 year fixed mortgage (it’s been closer to .75% recently). Therefore, if we assume a 4 percent interest rate for the 30-year fixed mortgage, we can assume a 3 percent interest rate for a 15-year mortgage.

Second, due to the lower interest rate and higher initial principal payments on a 15 year fixed mortgage, you won’t pay nearly as much in interest over the life of the loan. The extra money you pay every month on a 15 year fixed mortgage goes towards the principal, reducing the amount of interest you pay the following month.

Let’s take a deeper look. The below table shows the first year of a 15 year fixed mortgage at a 3 percent interest rate.

Interest and Principal Paid in Year One of a Fixed 15 Year Mortgage

Immediately you can see how much more of your monthly payment goes directly to the principal. For example, as a result of moving from a 30-year interest rate at 4 percent to a 15-year interest rate at 3 percent, your payment will increase from $477 per month to $690. Understandably, this increase of $213 may stretch someone’s budget. However, with the 15-year mortgage, 441 dollars will pay down principal right away, more than three times the amount of a 30-year mortgage.

Since mortgage interest is based on a simple interest calculation, this creates a snowball effect where you pay less and less interest every month. While the same happens with a 30 year fixed mortgage, it occurs much faster with a 15-year mortgage.

Should You Invest Extra Money or Pay Off Your Mortgage Early?

The answer to this question is a personal decision. The math usually says to invest extra money in assets with a higher rate of return. However, there are many behavioral benefits to paying off your mortgage.

First of all, if you are in a position to make this decision, congratulations! This likely means that you are in a solid financial position. I would not recommend overpaying your mortgage unless you have all other consumer debt paid, three to six months of emergency savings, investing 15 percent in tax-advantaged accounts, and saving for your children’s college funds (if applicable). If this all seems overwhelming, I suggest looking into Financial Peace University to take your first steps to build savings and reduce debt.

Many in the personal finance community believe that paying off a mortgage early is a terrible financial decision (though I wonder if opinions have changed with the current pandemic). They’ll say interest rates are historically low, and you can make a higher interest rate elsewhere.

I’m not going to argue with this approach from a mathematical standpoint. However, my argument is if you plan to pay the minimum on your mortgage, then do whatever you can to take out a 15 year fixed mortgage.

If we had taken out a 15-year mortgage, I’m not sure if we would have aggressively paid down our mortgage as we did. With a 15 year fixed mortgage, you can build equity much faster, plus take advantage of a lower interest rate.

The one place where a 30-year mortgage may make sense is when you pay it off like a 15-year mortgage. Even though the interest rate will be higher, if you were to pay an extra $200 per payment, your paydown would act similar to a 15-year mortgage. The challenge here is it takes a lot of financial discipline to make payments on your 30 years fixed mortgage that would be similar to a 15-year mortgage.

Interest Paid on a 30 Year Mortgage

To summarize this post, with a 30-year mortgage, you pay an insane (to me) amount of interest during the first several years making minimum payments. Combine this with the fact that most people will only keep their 30-year mortgage for 6 to 10 years before refinancing, moving, defaulting, or other reasons.

You will build up very little equity during the first ten years of a 30 year fixed mortgage, so many people start over with a new 30-year mortgage several times. Even if you don’t start over, it takes 15 years to get to the point where you pay more towards principal in a month than interest.

Something not discussed earlier is the relationship between longer loan durations and price. Longer loan duration may make homes and cars more affordable every month in the short run; however, in the long run, the lower monthly payments stretched out over a more extended period usually results in higher overall prices.

You can especially see this happening in the auto industry, with loan duration increasing over the past decade, averaging almost seven years. Expect a future blog post at some point with further analysis on the relationship between longer loans and price.

Back on topic, the 15-year fixed mortgage comes at a higher monthly cost and may limit flexibility a bit, but the benefits outweigh the 30-year fixed mortgage in almost every other aspect. For example, interest rates are lower, equity is built more rapidly, and you will pay off your loan much faster.

Over the life of a $100,000, 30 year fixed mortgage at 4 percent, you’ll pay $71,870 in total interest making minimum payments.

Over the life of a $100,000, 15 year fixed mortgage at 3 percent, you’ll pay $24,305 in total interest making minimum payments.

So whether you can make extra payments on your mortgage or not, you should strongly consider a 15 year fixed mortgage instead of a 30-year. However, if you go with a 30-year mortgage for the payment flexibility, do your best to pay it off like a 15-year mortgage.

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

The amount of interest saved on a 15-year mortgage vs 30-year is crazy. At first, it looks like you would save half the amount, but the math doesn’t work that way. Thanks for explaining those numbers. If we ever got a new mortgage, it would be 15-year for sure.

Personally, I’m torn on what to do. In fact, I’m going to start working on a blog post for March that lays out our situation, with a poll to see what people think we should do. There are a few other benefits to paying off the mortgage early that I’m interested in, that might tip the scale, and I’m curious to see what the community thinks is the best option (and why).

I’m going to reference at least one of your articles (with a link), because I think you do an excellent job going over the math.

Can’t wait to see the blog post! If you’d like to discuss ideas let me know. I’d be happy to talk through your situation.

Even though we decided to pay down our mortgage, I don’t think it’s the right call for everyone. However, I do think going with the 15 year mortgage (or at least paying down a 30 year mortgage like a 15 year) is the right move for anyone with the financial means to do so. Otherwise it takes so long to build principal.

Great post! I 100% agree with your hatred of the 30 year amortization!!

When my hubby first pitched me the idea of paying off our mortgage, I totally rejected it. At the time – I felt like the choice was clearly in favour of going with the math and investing elsewhere.

He eventually won me over, and I can honestly say (for us) it was the best decision we ever made on our path to Financial Freedom. Getting rid of such a significant monthly payment gave us immense choice, which is difficult to put a price on from a psychological perspective.

While we were ultimately able to double up our weekly payments, we also had the ability to make lump sum payments against the principle annually. One of our favourite things to do when we made a lump sum was to sit down at the computer together and see how much interest we saved ourselves, and how much time it took off our amortization, just by making our lump sum payment.

As you mentioned, early on – even with small lump sum payments, the savings and reduction in amortization were ridiculous! It was super motivating, and always drove us to work even harder to save up for the next one!! Frankly, I think it kept us way more focussed on our overall financial strategy then if we had just invested the money.

Thanks so much for taking the time to share your story! I love that you shared in the excitement as you watched that interest go down every month. I remember being so excited when we started paying more in principal than interest! It’s awesome to have you in the no mortgage club. Would love to hear about what you’re doing with the money that used to go towards he house

It changed over time. When we were paying the mortgage, we worked at reducing our cost of living to about 20-25% of our combined incomes. With double up payments and lump sums, 50% of our combined income was going towards the mortgage, and the remaining 25-30% was going into savings.

Once the mortgage was gone, we boosted our savings rate with the extra cash, as well as saving for our “Financial Freedom reward” (I have a post about that next week!), and we continued to work at building “passive” income streams to replace 50% of our working income.

We ended up retiring about 18 months ago.

What an incredible story! I’m looking forward to your post next week.

Now that we have paid all of our debt we are going to start building passive income streams as well. Most all of our net worth is locked up in our home, retirement accounts, and a pension. While I feel good about setting this baseline, we need to start buying more assets that can be leveraged well before retirement. We hope to purchase a rental property in the next year or so.

Wow, I can’t tell you how much this speaks to our current situation.

We just paid off all of our consumer debt and are saving for an emergency fund over the next few months. We are trying to figure out if we are going to focus on paying down the mortgage as fast as possible, or ignore the mortgage and dump into investments.

I went through the numbers, and I calculated that if we just pay the min on our 30-yr mortgage, we will have about $500,000 more dollars after 26-years (the amount remaining on our mortgage). That sounds like a lot of money (and it is), but looking at the numbers, it is not a huge difference compared to focusing on paying off the mortgage.

I’m going to be posting an article in the middle of march that goes through these numbers with three different options, and let people vote through a poll on which option they think is the smartest move.

Stories like yours and FP’s are making me think there is something about getting rid of the mortgage that is more life changing than keeping it as long as possible. Yeah, in theory, if you can be a perfect unicorn your whole life, maybe not paying off the mortgage early is the best option. But we aren’t perfect unicorns.

Chris – you really nailed it in that last sentence! If we could all stay focussed, and committed without straying from the plan for 25-30 years, it would sure make the decision an easy one!

But given our human nature, the way we interact and perform with short term vs. long term goals, our relationship with money, emotional ability to invest consistently over the long term, etc etc…..the decision becomes a completely individual one. One that takes into account so much about our own nature, rather than just the numbers.

I consider myself to generally approach life in a logical fashion, numbers speak volumes to me. But I also can’t deny that I tend to work in a more focussed/intense manner when faced with shorter term goals. This was particularly true when it came to paying off the mortgage. Because I could see how the goal would give us choice (not even that we were planning on retiring early, but just the thought of CHOOSING to go into work every day rather than HAVING to), I became more creative and crafty at finding ways to pay it down faster.

Much more so than I ever would have been when tasked with investing over the long term.

I’m excited to read your post on the options you’ve identified!

FP – sounds like you are in a super similar situation to where we were not all that long ago. We had the majority of our net worth in our house, pensions, and retirement accounts as well. But once that mortgage debt was paid off – it was insane how quickly the savings accumulated and the passive income streams built. Sounds like you are at that tipping point right now! Having been landlords for the past 12 years or so, I am biased, but very in favour of real estate as a method of building those passive income streams. Very excited for you!

This is so well stated, Phia. I could not agree more about the behavioral aspect. For a few years we were putting our money in index funds instead of the mortgage. Instead of just leaving it there we ended up spending the money on home improvement projects, new (used) cars, and vacations. We just didn’t have the discipline to leave that money there for 30 years. I’m guessing we’re not alone here.

Once we made a decision to pay off our mortgage we had a new focus and intensity around it. Now that it’s paid off it will take us a while to build our savings back up, but once we do we are planning to jump into real estate investing. I need to read more about your story, but am curious if when you made the jump to real estate if you bought with all cash or took out loans (at least at first)?

Thanks!! Yah you are definitely not alone in that department – even for the most well laid financial plans, it’s hard not to get distracted by other priorities over the course of decades!

While the value of long-term investing can’t be denied, I do find it really helpful to keep it as a consistent side activity I do alongside other financial plans/goals. Approaching it this way works with our dollar cost averaging investment approach, always keeps our savings building, but also leaves room for more “interesting” goals to sink our teeth into lol.

As for real estate – we got involved in owning rentals in a somewhat unorthodox way! I have always had a passion for owning property (I bought my first condo when I was 18, and took possession on my 19th birthday!). I was lucky enough to hit a great time in the market, and a few years later I sold my first condo, using the gains to purchase two properties in relatively quick succession. My own residence (a condo in bad need of a full renovation) and a townhouse to rent.

At 24 I found myself in the midst of a divorce (I was way to young to be married in the first place!), but I leveraged myself to the hilt to keep both the half renovated condo and the rental. That all happened literally months before the market crash of 2008. Some hard life lessons learned about real estate over the years that followed that!

Ironically, Mike also extensively leveraged himself to retain his primary residence during his divorce (also married way to young!) We later turned his residence into a rental property as well, and then also built a basement suite in our current home.

While we have no plans to leverage ourselves in that fashion moving forward, we do plan to only invest cash for the downpayment of future investment properties (Canada mortgage rules require a minimum 20% down for secondary/investment properties) so we will aim to be in the 25-30% down range, and mortgage the rest (taking advantage of the tax efficiency of the mortgage interest).

While our aim is to only buy properties that produce a positive cash flow of +5% annual return on our capital invested, we also prefer to stick with longer term holds as opposed to flipping (which we have done a few times, but don’t particularly love, a little to time intense for us at this stage).

We’ve been looking pretty hard for our next rental, but over the past few years the market here in Vancouver has been NUTS, but it is starting to show signs of weaknesses. Very much a personal view, but we do believe that our market is going to have some corrections over the coming 18 months, so we are trying to be patient and see what happens.

I’m not sure what your market has been like – but you may very well find yourselves getting into the real estate game at a very ideal time!!

I do have a couple posts about our thoughts on buying your first investment property if you want to check them out, here’s the first one and it has links to the other in it 🙂

https://freedom101.ca/2018/01/08/investing-in-real-estate/

PS: Sorry for the ultra long winded response!

Wow, purchasing your first property at 18 is really impressive! I’ll check out your post on investing in real estate. We are in the Midwest in the US, so prices are still reasonable.

Eventually we want to own rental properties free and clear as well. What we’re thinking through now is if we should save up money and pay all cash for any rentals, or if we should buy a few properties with a 20 percent down payment then start paying them off. We could buy three or four properties using loans and then pause until they are paid off and then repeat. Right now we’re working to build our savings up to $50,000, which will most likely take most of this year if everything goes as planned. At that point we’ll make a decision on what to do next.

Thanks again for commenting. Your story is very inspiring!

Thanks!!

Sounds like you guys have a couple great options – I don’t think either trumps the other. Cash purchase means more monthly cash flow which is always nice, whereas mortgaging to buy more properties upfront equates to (likely) more long term equity growth. So I think it would depend entirely on your objectives and intentions for the performance of the investment.

Thankfully I’ve defaulted to a more conservative stance over my life that served me well. A 30 year mortgage gave me breathing room to react to life where a 15 year mortgage would have been a real struggle for a year or two when things got rough. I’ve made extra payments for years that mimicked a 15 year, but for those 14 months where that wasn’t a possibility my 30 year mortgage payments made all the difference. Living in Washington DC isn’t cheap, so a 15 year mortgage on what houses cost here is pretty aggressive!

We actually did the same thing before starting to more aggressively pay ours off. My hatred of the 30 year mortgage is probably a bit overstated. It’s really the interest in the first few years that I despise.

I know a 15 year mortgage may not be realistic for everyone, especially in HCOL areas, but I do think people should try to chip away at the initial principal on a 30 yr loan so that a huge percentage of money doesn’t go towards interest.

Thanks for sharing your thoughts!

Great piece. I too hate long term loans.

When I bought my first home in 2007, yes just before the collapse, I was naive. I knew nothing about finance and just looked at the monthly payment. I was coming out of graduate school with no money-zero. The bank handed me a 40 year no money down loan. Yes, 40 year. I thought this will be fine and in a few years I’ll refi. It was a disaster, but I finally managed to sell the house and lost a lot of money.

Today, I own a home that is half the cost of the first one. Purchased it on a 15 year term and will pay it off 10 years early. I think people should start with a low cost home and upgrade as they build significant equity (if they really need more space).

As far as paying off loan vs. investing, I too think it is a personal decision. However, unless you have a 30 year, sub 3% loan, then the math isn’t all that easy. Rates are rising and stocks will definitely not return what they have over the past 10 years over the next ten. Over the long term the stock market will likely pay a higher return, but across decades this varies tremendously. I would consider current interest rate on loan, time frame, and consider likely returns in the coming decade or two. If you have a 4.5% or higher, I would probably pick paying off loan. Debt free is forever.

I am going to have to run the interest numbers on a 40 year loan. That is a really long time!

It sounds like you are doing great if you’re able to pay off a 15 year loan in 5 years. I agree with your upgrade comment, though also know that in some high cost of living areas homes can be really expensive.

This discussion is complicated because different strategies make sense in different markets. There are huge differences in prices in high cost of living areas vs low cost of living areas. Also, your point about stock market highs is a good one. If this was 2010 and stocks just saw a massive drop, I would hope that I would have been smart enough to invest instead of throwing so much money at a 4% mortgage. When we decided to go all in to pay off our mortgage in 2016, stocks had already risen sharply to record highs at the time and that certainly factored into our decision to attack the mortgage.

I find this as a really interesting topic to think about and I’m glad you weighed in with your thoughts!

Really love the hard work and interesting research behind this post. I’ve always had the drive to annihilate any mortgage we’ve had despite the math about investing it instead. I just hate the idea of paying interest to anyone and always have! I’ve never run the numbers on our specific houses (we paid off each house in less than three years), but your logic here backs up my intuition. Thanks for your perspective and indisputable numbers!

Thank you! That is really impressive that you’ve been able to pay off multiple houses. Congrats! While the numbers generally don’t favor paying off the mortgage, this hopefully shows where there are situations where making additional mortgage payments does make sense.

3.375% 30 year mortgage here (just about 7 years in because we refi’d to a lower rate after the first year). I think if my mortgage was small like yours was, we would be solidly focused on paying it off fast. The numbers start to look different in a HCOL area I think. Still, I am currently paying an extra $100/mo, so I’m not entirely convinced that we won’t pay it off early 😉

The numbers definitely look different in HCOL areas. If our mortgage was several hundred thousand dollars we would have taken a different approach. I’d like to think we would have at least tried to pay it like a 15 year mortgage since so much money goes to interest the first few years. Every situation is different though!

What if you tried a different approach. Especially for folks trying to get into their first house. How about applying extra money toward principal every month and aim to pay it off in 15 years, but have the buffer of the 30 year if there are months where money is tight. It is an eye opener to see how much is principal in the beginning,

Well if I’m being honest, this is exactly what we did. I can’t fault anyone for paying down a 30 year mortgage like a 15 year if they actually stick with it. The reality is that many will have challenges paying a 30 year mortgage like a 15 year. The reason I don’t like the 30 year mortgage is because you pay SO much interest up front. If you can knock down some of that interest right away there are huge benefits. Thanks for commenting!