After following the Dave Ramsey baby steps for nearly seven years, my wife and I recently decided to take the Financial Peace University (FPU) course through our church. Shortly after, we co-led our own Financial Peace University class. Many Financial Peace University reviews exist, yet we hope you benefit from our story. Especially since we have first-hand experience as participants and leaders of the materials.

Financial Peace University Review

In 2011, we were introduced to the concept of becoming debt-free through Dave Ramsey’s book, Total Money Makeover. Even though we were already on a debt pay-down journey for years, it was refreshing to go back to the basics in Financial Peace University to see firsthand how other people reacted to Dave’s philosophy.

Dave Ramsey has been more successful than just about anyone at encouraging a diverse audience to eliminate debt and live a more purposeful life. There have been many conversations in the personal finance community about reaching the low-to-moderate income population more effectively. I suggest starting with Financial Peace University as the class begins with the basics of personal finance. Dave effectively rolls out basic personal finance principles such as budgeting in an inspiring way.

What is Financial Peace University?

Financial Peace University is an interactive nine-week course facilitated primarily by weekly videos featuring Dave Ramsey. The course materials are frequently updated. While you can purchase the course material and take it yourself, I’d highly recommend seeking a small group to go through the course together.

The real magic of the course comes through the small group discussions, which also create accountability. It’s similar to the Weight Watchers approach, creating a small community of individuals who hold each other accountable. After all, personal finance and diet have similarities. The overall concepts are simple, but the actual doing is hard.

The Financial Peace University course is based on biblical principles. Many people may not know that money is one of the most referenced topics in the Bible and has been mentioned more than 800 times. If you aren’t a Christian, I won’t let this deter you from taking the class. The biblical teachings are primarily referenced in ways that would be non-threatening to non-Christians. We had a family in our class who was not religious, and they were two of the most engaged individuals in the class.

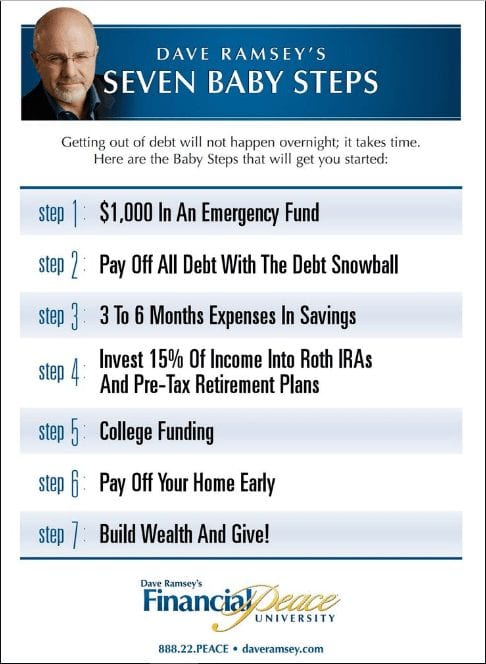

What are the Baby Steps in Dave Ramsey’s Plan?

Dave uses a seven-step approach to eliminate debt known as the baby steps. Once you become debt-free (baby step 2) and save up a three-to-six month emergency fund (baby step 3), people can usually start moving to more advanced personal finance guidance.

For example, in baby step 6, the goal is to pay off the mortgage. Even though we decided to pay off our mortgage, the same may not be best for others depending on an individual’s unique circumstances (my opinion, not Dave’s).

The Financial Peace University Baby Steps

1) Save $1,000 In An Emergency Fund

2) Pay Off All Debt With The Debt Snowball

3) 3-to-6 Months of Expenses in Savings

4) Invest 15% Of Income Into Roth IRAs and Pre-Tax Retirement Plans

5) Put Money In Savings for College Education

6) Pay Off Your Home Early

7) Build Wealth and Give

What Does Financial Peace University Cost?

There is often debate around the price of Financial Peace University. Even the pastor at our church made a snippy comment that we could all have financial peace if we sold thousands of courses for $100 apiece.

Our cost to purchase the materials for Financial Peace University was $100 through our church. The regular online price if you buy on its own is $129. However, there are often deals where you can purchase for $79.99

I do not have an issue with the price. While $129 is a lot of money, it encourages commitment to the course. I’ve heard many Financial Peace University leaders comment that the first people to drop out are usually where someone else purchased their course materials. If you can implement the framework from Financial Peace University, it will be well worth the expense.

How Long is the Financial Peace University Course?

Financial Peace University is a nine-week course led primarily through videos featuring Dave Ramsey and other speakers at his company. Below are the topics covered by Financial Peace University. Please note these lessons have been updated for the 2019 new curriculum.

Starter Emergency Fund + Budgeting – Lesson 1

This lesson overviews Financial Peace University and the importance of starting a small emergency fund. This lesson is designed to get you excited about saving!

Pay Off All Debt – Lesson 2

This is arguably the most critical lesson in the series as it provides a road map to pay down all debt. Unfortunately, this is also the most challenging lesson, and many families get stuck or give up. But, commit to following Dave’s plan, and you’ll be amazed at the life-changing results.

Save a Fully Funded Emergency Fund – Lesson 3

The third step in Dave’s plan is to save three-to-six months of expenses in an emergency fund. If you reach this step, you will take all the money you have been paying towards debt and shift it to building your emergency fund. Your emergency fund will provide the runway if you ever lose a job unexpectedly, have an unexpected home repair, or get hit with a large medical bill.

Invest for the Future and Build Wealth – Lesson 4

Initially, this lesson can be challenging to connect to if you are drowning in debt and living paycheck-to-paycheck. However, millions of other families have made it to these steps in the process. So stick to the process, and don’t underestimate that small wins over time lead to massive ones down the road.

Buyer Beware – Lesson 5

You can draw on Dave and his team’s years of selling and marketing experience to show you exactly how all of these businesses get their message deep into your subconscious. This lesson will show you how to finally gain power over your purchases and get the best deal when you’re ready to buy.

The Role of Insurance – Lesson 6

You’ll walk through several types of insurance every adult needs and reveal how to avoid traps in the insurance industry that can leave you flat broke. In addition, this lesson will teach you about life insurance, health insurance, and other specialty plans.

Retirement Planning – Lesson 7

This lesson will help you better understand all those confusing initials and abbreviations that come with investments: IRA, 401(k), 403(b), 529, and more! You’ll learn to ensure your kids get through college without a student loan!

Real Estate and Mortgages – Lesson 8

You’ll learn many practical tips for buying and selling your home. This lesson breaks down the different mortgage options to reveal the best (and worst) ways to buy a house.

Outrageous Generosity – Lesson 9

Last but not least, this lesson discusses the commonly held misconceptions many people have about giving and reveals the valid key to winning with your life and your money. This lesson shows why taking control of your money is important.

Who Participated in Our Financial Peace University Class?

I don’t want to share too much information about other families in the class. However, I think it’s appropriate to reference the success of our group in aggregate terms.

There were eight to ten families who originally joined the class. I believe this is a typical class size for a Financial Peace University class. By the final week, there were six families still attending regularly. Many individuals asked challenging questions during the first few weeks and pushed back on the concepts. You could tell that even saving the $1,000 emergency fund (baby step 1) was an impossible task for some individuals.

By the final week, the five families (not including us) had increased savings or paid down debt by $21,000! That is more than $4,000 per family in just over two months. Dave is an exceptional motivator. You could tell the people that stuck around to the final week were on board with his approach and had changed their financial lives to achieve their goals.

My wife and I stayed relatively quiet during the classes. We were mainly there to listen and observe and didn’t want to step on the toes of the facilitators. Revealing that we were debt-free besides the mortgage may have made people wonder if we were only taking the class to brag or show off our success.

We didn’t reveal to the class that we were in baby step 6 until the final week. It’s not that we were trying to hide our success over the years, but we missed a few weeks early on, and there wasn’t a good time to bring it up without going out of our way.

What Did We Learn?

As a regular consumer of personal finance-related information, I wasn’t expecting to learn much. However, there were a few videos where I had several takeaways. For example, there were eye-opening moments during the “Role of Insurance” lesson.

We have life insurance through my work but probably need additional term life insurance through a different provider. We also plan to shop our insurance rates and explore an umbrella policy since our net worth has increased over the past several years.

Whether you are a personal finance nerd like me or brand new to the concepts, this class has something for all. I found that concepts that are common to me, such as budgeting, eliminating debt, and building emergency savings, were entirely new to others. What Dave does so well is explaining the “why” behind reducing debt and increasing savings.

Is Financial Peace University Biblical?

Yes, and no. But mostly, yes. Dave is not shy about sharing that Financial Peace University is based on biblical principles. His story is that after going bankrupt earlier in his life, he turned to the Bible to help better manage his finances. What he learned eventually turned into Financial Peace University.

I say no because even though Financial Peace University is based on biblical principles, the references to the Bible or Christianity are not off-putting to non-believers. Sure, a few Christianity references are mixed throughout the class, but the comments are few and far between. In the two types I’ve participated in, we had non-Christians who were some of our most engaged participants.

Financial Peace University Review

I believe just about anyone could benefit from joining a Financial Peace University small group. Even individuals who are savvy with personal finance would benefit from the group aspect. I learned a lot about other people’s challenges in getting out of debt. Even saving that first $1,000 can be a considerable task depending on a person’s situation.

Even though we didn’t wholly follow Dave’s guidance on our debt pay-down journey, I have a better appreciation for his approach after going through the class. For example, while I don’t necessarily agree with his advice on credit cards, I came to understand his reasoning better.

It’s easy for someone already financially responsible to leverage the benefits of credit card reward points. With that said, someone lacking financial discipline could find themselves in debt with extremely high interest rates using credit cards.

Reading The Total Money Makeover back in 2011 was one of the best things to ever happen to our family. Digging our way out of debt has helped us set a strong financial foundation. As someone in our group said during the final week, “This is life-changing stuff, and it needs to be shared more broadly.”

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

I still need to do the same! Planning for this week. 😁

Glad you enjoyed it! If you have other questions let me know.

That’s awesome! I’m hoping to have a similar impact on others by leading a class in the future. Dave does such a good job motivating people to pay off debt.

Thanks for sharing. I’m in the process of getting quotes from a few different insurance providers. Looking at 20 year term policies. If it ends up being more than $20 or so a month I’ll probably pass. That money would be better invested elsewhere.

The community aspect makes taking the class worth it, in my opinion. It’s great to see people who can be resistant at first come around to the concepts and finish with big wins.

You’re welcome! After taking the class I can certainly see why he is so effective in connecting with people. He does a really good job of motivating and educating in a very simple way. I know not everyone is a fan of him, but it’s hard to argue with his track record of getting people out of debt.

Thanks so much for commenting. This is probably a better review than mine!

We had one individual in our class who took the class solo and she was there until the end so it probably all just depends. Also, I agree with the need to save more than 15% if getting started later in life. Late starters won’t be able to benefit as much from compound interest so saving more many be necessary.

Thanks for reading!

Agreed. Even though my wife has been onboard with our debt payoff journey, this really helped us both to better understand the why so we’re more on the same page. Thanks for stopping by.

I constantly spent my half an hour to read this weblog’s content every day along with a mug of coffee.

Thank you for the kind words! I’m glad you enjoy the content.

Greetings I am so happy I found your webpage, I really found

you by mistake, while I was browsing on Bing for something else, Regardless I am here now and would just

like to say kudos for a fantastic post and a all round exciting blog (I also love the theme/design), I don’t have time

to look over it all at the moment but I have bookmarked it and

also included your RSS feeds, so when I have time I will be back to read much more, Please do keep up the excellent job.