The housing market is heading into waters not charted in decades. We haven’t had to deal with several factors at play in a long time, including high inflation, rising interest rates, low supply, and rapidly increasing home prices. All of these factors beg the question, will the housing market crash?

Like the stock market, everyone has predictions about what will happen over the next few years, but almost nobody knows. For example, looking back at the 2008 housing bubble, the issues resulting in the recession seem obvious today in hindsight. However, at the moment, almost nobody saw the housing market crash coming. At least not to the severity, which almost brought down the entire economy.

We will look at several factors related to the housing market and highlight how this market compares to 2008. From there, you may be able to draw your conclusions about where the housing market might land in a few years.

Will the Housing Market Crash?

Below are several factors that compare today’s housing market to the 2008 market. The housing market today is undoubtedly very different from back in 2008. Of course, many will say that those differences mean there will not be another housing market crash. However, a few factors make you wonder if history could repeat itself, just in a different way.

Increasing Interest Rates

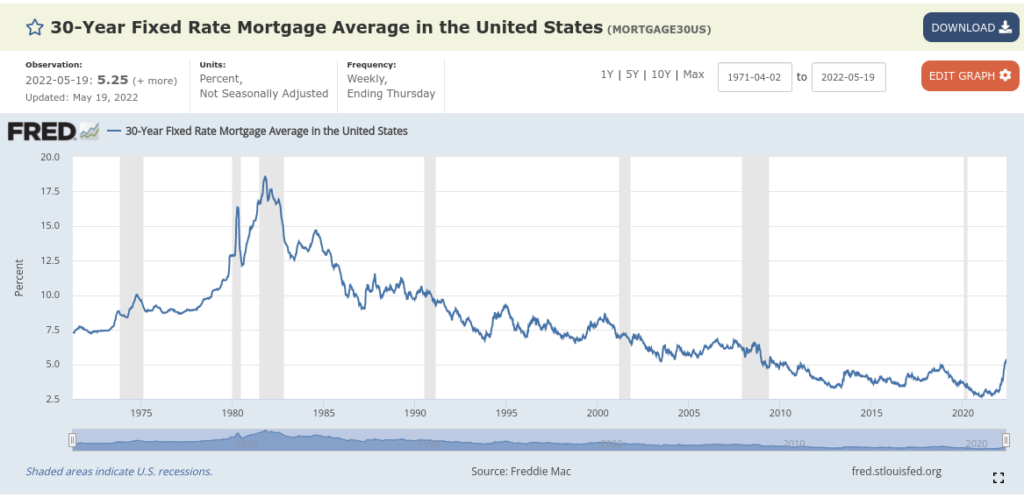

There has been a rapid increase in interest rates during the past six months. In 3Q 2021, 30-year mortgage rates on loans were less than 3%. Mortgage rates today are currently over 5%. Historically, mortgage rates remain relatively low, though experts predict interest rates will continue to rise over the next few years until inflation returns to a lower rate.

In 2005-07, interest rates started to tick higher slightly, but nothing like what we are seeing today. So forecasters ask how high the interest rate has to go to slow down an overheated housing market. Or are we already starting to see a market slowdown? Recent data shows that may already be happening.

Rising interest rates don’t mean that the housing market will crash. If anything, the housing market may return to a more normal state. One where there aren’t 20 offers on most homes above the asking price. Most people base what they can afford on the monthly payment, and while it’s unfortunate that higher interest rates will price some people out of the market, it may also bring the market back closer to equilibrium.

Tighter Lending Standards

One of the most significant differences between the 2008 and 2022 housing markets is the overall tighter lending standards from banks and credit unions. In 2008, lenders were not as diligent today, especially when verifying income. Sometimes, a borrower would tell the lender their income or how much house they could afford without verification, and a loan was made available.

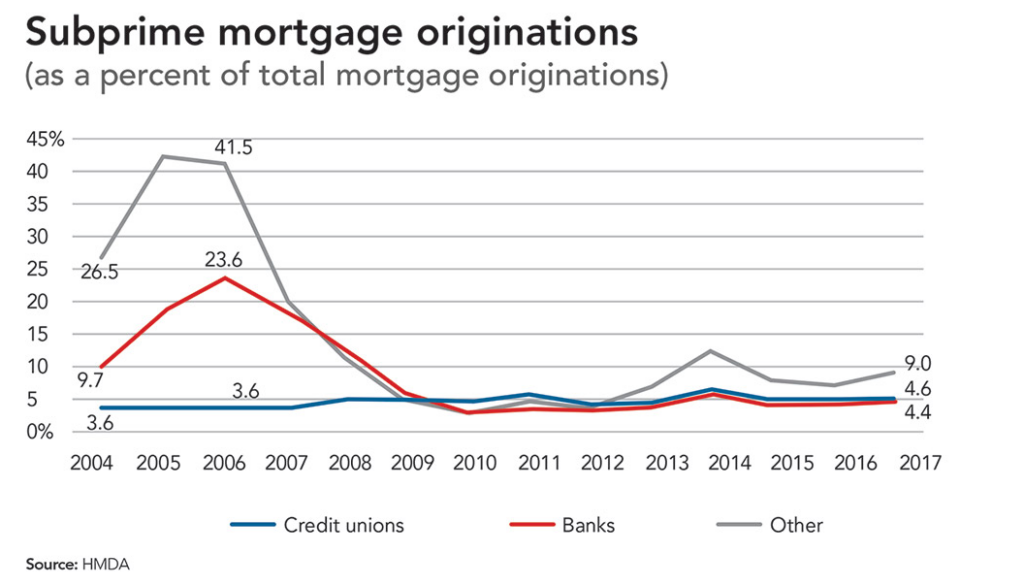

Today, lending standards are much tighter than in 2008. As a result, the percentage of subprime mortgage originations, loans made to individuals with lower credit scores that do not qualify for prime-rate loans, has decreased significantly. In the 2008 financial crisis, the primary driver of the crash was subprime lenders that allowed people to purchase homes much more expensive than they could afford.

The chart below shows the difference between the percentage of subprime mortgage originations in 2004-2007 and as recent as 2017. The significantly lower percentage of subprime mortgage originations may be the most robust case that today’s housing market is much stronger than in 2008.

High Demand and Low Inventory

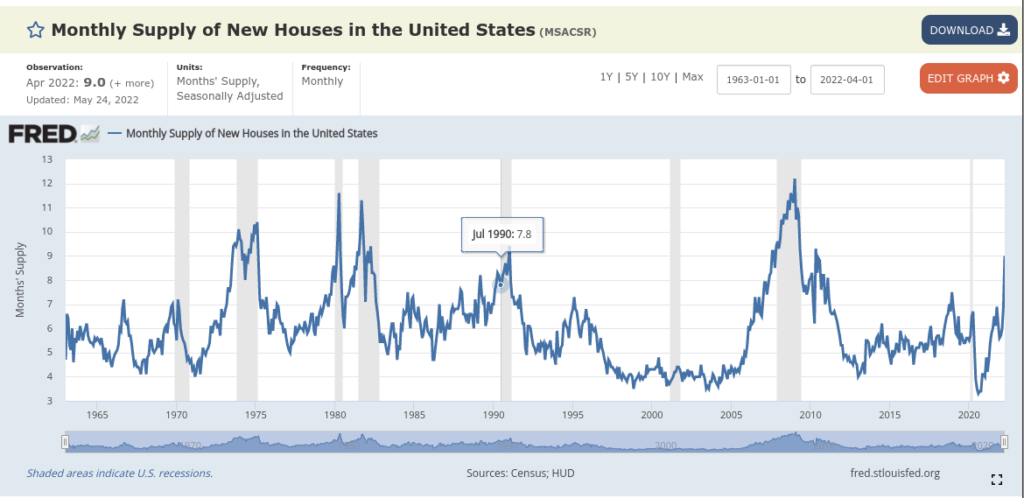

Millennials have reached peak home-buying age as we are still digging out of supply shortages from the 2008 crash. With most millennials in their 30s and some even reaching their early 40s, there’s been an increased demand for housing. Combined with the fact that home buying came almost to a standstill during the pandemic, there has recently been an enormous wave of demand. Higher interest rates have started to slow that demand, though it’s still outpacing supply.

Homebuilding decreased significantly around the 2008 housing crash. It has taken years for home building to resume at a rate needed to replenish inventory as millennials enter the home-buying market. The good news is that supply is increasing, as indicated in the chart below. It will be interesting to see what the future holds with interest rates growing rapidly and supply starting to catch up with the increased demand.

Adjustable-Rate Mortgages Increasing

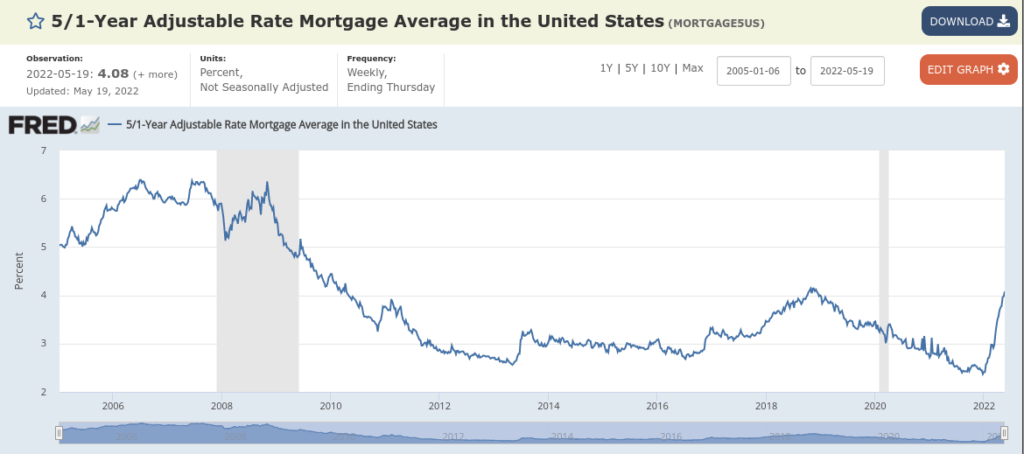

One of the factors of the 2008 crash was adjustable-rate mortgages. With the high number of subprime loans, once interest rates ticked up and job losses happened, many buyers stretched to their limits and could not afford their mortgage payments. However, as noted earlier, subprime loans are significantly lower than in 2008. Additionally, up until recently, adjustable-rate mortgages have stayed relatively low, but that is starting to change.

An adjustable-rate mortgage has a variable interest rate. Therefore, as interest rates increase, so does the monthly payment on the loan eventually. With real estate prices at all-time highs, interest rates rising, and increasing inflation, something has to give for some buyers to stay in the market. While adjustable-rate mortgages do not provide a significantly lower interest rate than fixed-rate mortgages, it might be enough to allow that home buyer to afford the monthly payments for now. Therefore, adjustable-rate mortgages are something to watch as the housing market evolves.

High Inflation

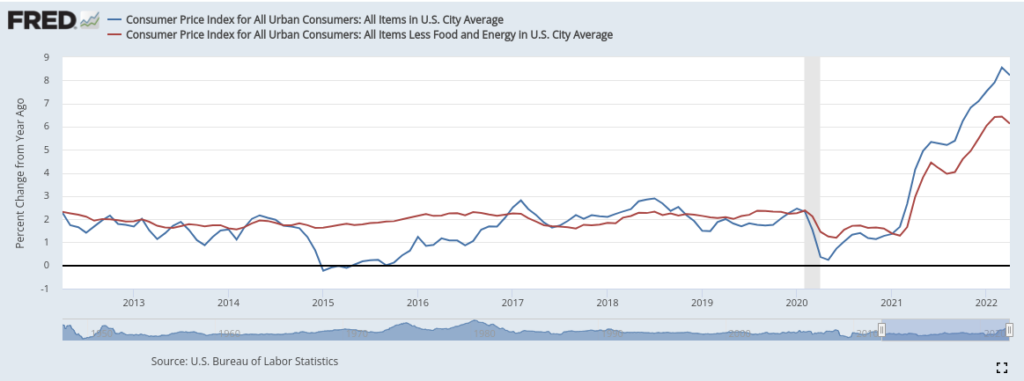

High inflation is a factor we haven’t dealt with in the housing market for decades. When inflation rises well above 2%, the overall cost of living goes up. Wages generally do not increase at the same pace when inflation is abnormally high as it is today. The worst-case scenario is our relatively high inflation doesn’t get under control and spirals into hyperinflation.

The last time inflation was as high as today, housing prices continued to increase. However, the median home price has grown at a much more rapid pace over the past two years. For example, the median price of a home in Q2 2020 was $322,000, while the median price as of Q1 2022 was $428,000. That’s nearly a 33% increase in median home price in only two years.

Therefore, it’s tough to understand how inflation may impact house prices. However, one thing is almost inevitable, rising mortgage interest rates will limit home price increases to the clip we’ve seen over the past two years. It seems unlikely to see significant decreases in median home prices, but it is tough to predict the future.

The Stock Market is Down

The stock market decreased by about 20% in 2022. A down stock market might not impact the housing market in the short term, but a sustained down market can undoubtedly affect it.

If the stock market remains low for a sustained period, eventually, companies will begin to lay off staff. People out of work tend to have difficulty making their mortgage payments. When people cannot make their mortgage payments, they start to default on their homes and move to foreclosure. Foreclosures increase the housing supply on the market, thus potentially driving down or stabilizing high prices.

A down stock market can also expose economic cracks that are not always apparent in good times. Back in 2008, bad loans propped up the housing market. These bad loans generally performed well in a strong economy. However, once the market showed signs of weakening, the house of cards came crumbling down.

Today, what cracks in the market will be exposed if the stock market remains low for a significant period? It likely won’t be in the same places. However, if the housing market were to crash, it would likely be from something we don’t expect.

In Summary: Will the Housing Market Crash?

The housing market is the foundation of our economy in the United States. In 2008, when the housing market crashed, it nearly brought down the global economy. The market took about five years to recover, which was a tough time for many people.

So the question we ask here is, will the housing market crash again in 2023?

The 2023 housing market is different than in 2008. The 2008 market was propped up by bad loans when inventory was far outpacing the need for housing. For years after 2008, homebuilding significantly slowed in most markets. As a result, we are still playing catch-up.

Combining the lower supply with the fact that millennials are reaching peak home-buying age, there is a real supply crunch going on right now. Additionally, this market has far fewer subprime loans compared to 2008. Lending standards are much tighter, and many homeowners have a lot of home equity, which reduces the risk of a foreclosure run.

As interest rates on mortgage loans remain higher than in the last decade, we’ll likely see a cooling of the housing market. A cooling that is desperately needed. A cooling that has likely already started. Home prices have increased by more than 30% over the past two years, which is unsustainable. As a result, we may move from a vast sellers’ market to a more buyer-friendly market.

However, there are a few wildcards at play. If you were to ask someone in 2007 if they thought the housing market would crash, most would have said that housing prices never go down. That was the mantra leading up to 2008, and many investors bet big on house prices never going down and got burned by their speculation.

Therefore, the wildcard is the unknown. The unknowns would be something not mentioned in this article that most people aren’t considering. Several key risk factors are at play, with higher interest rates, the highest inflation in decades, and a down stock market. These risk factors can allow other unexpected risk factors to materialize. Therefore, if the housing market crashes, it will likely result from something very few expect.

This post originally appeared on Financial Pilgrimage.

More From Financial Pilgrimage

- 3 Key Lessons Learned From the Last Recession

- Experts Explain Hyperinflation and 8 Ways to Prepare and Protect Your Money

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.