Since paying off our mortgage in early August, our spending has been somewhat out of control. After years of aggressively paying down debt, we took some time to splurge. In September, we attended FinCon and capped off the trip with a short vacation in Fort Lauderdale. We had several significant life changes earlier in the year, including going from two incomes to one and having our second child. It’s time to get our spending back on track before heading into the new year.

Our Monthly Expenses After Becoming Debt Free

A lot has changed since we started our debt free journey in 2011. At the time, we were a single-income family as my wife had gone back to school to get her teaching certificate. Early in my career, I made good money but was only a little above median income.

Our debt was spiraling out of control. We were nearly $200,000 in debt and on a path to continue taking on more. Turning things around seemed so overwhelming. But, as they say, a journey of a thousand miles starts with a single step. That single step was to track our spending.

Tracking our spending allowed us to understand better where our money was going so we could make adjustments. So if you are struggling financially, start by simply tracking your spending. You’ll be surprised how much clarity this will bring to your financial life.

Becoming Debt Free

Fast forward to when my wife got her first public school teaching job in 2012. At this point, we had been tracking expenses for several months. This baseline allowed us to put the majority of her salary towards paying down student loans. For years we slowly paid down our student loans and car payments. Finally, after a few years, the balance on our student loans was reduced to $23,000. At that point, we refinanced the remaining debt into our mortgage. I don’t necessarily recommend this approach, but it worked okay for us.

We didn’t make much progress for a few years after refinancing our remaining debt into our mortgage. Then, in 2016 we re-focused and went all-in to pay off the remainder of our mortgage, which was around $90,000 at the time. We immediately pulled $30,000 out of savings and then put every dime left over to the mortgage for more than two years.

Life Adjustments

We’ve had significant changes in our financial lives during the last few months. Having the mortgage paid has allowed my wife to stay at home with our new baby. Add in our trip and kitchen remodel, and our expenses have been all over the place. In this post, we will go into detail about our monthly expenses. Partially to be transparent about what we spend our money on, partly because we needed to sit down and do this anyway.

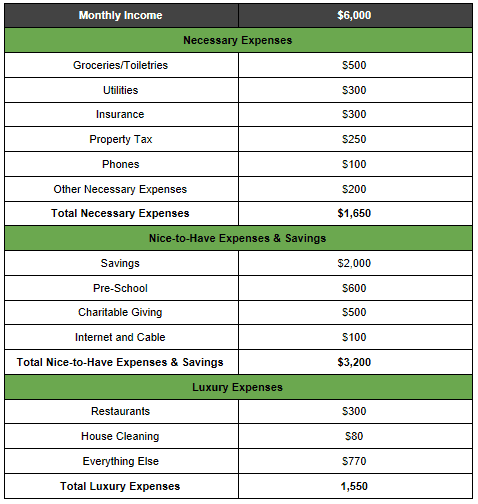

A few disclaimers: First, this post will only focus on expenses after take-home pay. The money that comes directly out of the check for taxes, retirement savings, insurance premiums, flexible spending account, parking, and other minor deductions are not included. After all deductions, we are left with $6,000 per month in take-home pay.

Necessary Expenses

These are the necessary expenses. If I lost my job and we had to rely on our emergency fund to live, these are the expenses we would continue paying. All others would either be cut out or significantly reduced. So while our current monthly expenses are much higher, we could probably live on around $2,000 per month, if necessary.

Writing this out gives me an appreciation for people who make at or below median income salaries. The median income in my state (as of 2011) is $45,000. Therefore, take-home pay would probably be around $2,500 to $3,000, which doesn’t leave much room after necessary expenses. Since we are debt free, we don’t have bills that many others have, such as a mortgage, student loans, or car payments. I understand that it can be challenging to get started, but by tracking monthly expenses, we can get a little better with money.

Groceries/Toiletries – $500

This expense is a bit higher right now as we include baby formula and diapers, which comes out to about $200 per month. Overall for groceries, we usually spend about $350 per month for our family of four (does not include going out to eat). For toiletries, we spend another $25 per week, on average.

Utilities – $300

Well, we have to live somewhere. This includes air conditioning, heating, trash, water, and sewer. We could probably trim this down a bit in an emergency. Some months this is closer to $200, with others being as high as $400.

Insurance – $300

This category includes car, life, and homeowners insurance. Car insurance comes in around $150 per month, homeowners at $100, and life at $50.

Property Tax – $250

We pay this annually, including property tax on our home and personal property tax on our vehicles.

Phones – $100

I’m not sure if phones are indeed a necessity, though it would have to get worse for my wife or me to get rid of them. But, on the other hand, we use our phones so much that it would be challenging not to have them, especially if we were suddenly out of work and had to find new jobs.

Other Necessary Expenses – $200

Other necessary expenses include medication ($45 per month), gasoline for our vehicles ($100 per month), and our two cats ($50 per month).

Nice-to-Have Expenses

After the necessary bills are taken care of, this next rung represents nice-to-have expenses, but we could do without if needed.

Savings – $2,000

Putting money in our savings (brokerage) account is the first thing we do after getting paid. Paying yourself first is so important. Tracking your expenses for a few months will give you a good idea about how much you can save or use to pay down debt each month. We hope to continue to increase this savings rate to get it back up to 50 percent of our income. We should be able to get close when our 4-year-old starts kindergarten next year.

Savings right now are going towards remodeling our kitchen. Once the kitchen is complete and paid for, we will begin saving for a rental property. Again, this is savings above what we contribute to our pre-tax retirement accounts.

A few hundred dollars here is also used as a slush fund for any vacation. We probably should also budget for cars, but we’ll pull money from savings when it comes time for new (used) vehicles.

Pre-School – $600

With the transition of Mrs. FP to a full-time stay-at-home mom, this has moved from a necessary expense to a nice-to-have. We decided to keep our 4-year-old in pre-school as he showed a tremendous amount of growth in his first year. We send him to pre-school at the public school district that we are in, which is significantly less expensive than other pre-schools in the area that can cost as high as $1,500 per month.

Charitable Giving – $500

I debated where to include this category. Part of me would hate to pull the plug on our charitable giving, especially the two children we sponsor overseas. While we’d likely keep donating to their causes, we’d probably pull back on some of our other charitable giving in a dire situation. Other organizations we support include The United Way, the Epilepsy Foundation, the International Institute, and our local church. We are so blessed to be in a situation where we can give away money to groups that we care about. We hope to continue to increase our charitable giving over the years.

Internet and Cable – $100

We have made some changes to keep these costs reasonable every month. For example, recently we switched our internet service provider and saved about $30 per month. We also moved from a traditional cable provider to Sling and have Netflix. As much as we’d like to ditch cable altogether, we enjoy live sports. It’s about all we watch this time of year.

Luxury Expenses

These are the expenses that would be cut immediately in a difficult financial situation. For example, when we started our debt pay down journey, we rarely went out to eat or had any extra spending money. However, now that we have paid off the mortgage, cars, and student loans, we have extra cash every month to do with as we wish.

Restaurants – $300

Going out to eat is something that our family values either for convenience or for a date night. We’ll usually do fast food about once per week and then try to go on a date night once or twice per month. Having grandparents willing and able to watch our two children keeps costs down since we don’t have to pay a babysitter. We eat at home often, so we appreciate it when we do have the chance to eat out.

House Cleaning – $80

This is probably my favorite $80 that we spend every month. We have someone come and clean our house once per month. It’s just often enough to keep us from having to dust the furniture, mop the floors, vacuum the rugs, and clean the bathrooms. We’ve talked about giving this up with my wife now at home full-time. But, for now, we are keeping it.

Everything Else – $770

Several small items come up every month that aren’t included above. A few examples include haircuts, swim lesson fees, minor home repairs, random trips to the zoo, tickets to sporting events, clothing, gym membership, and a variety of other expenses related to entertainment or impulse purchases.

These tend to be the variable expenses that we can quickly scale back on if an unexpected expense arises during a given month. We’ll also leverage funds from here (and restaurants) to fund emergencies. I know this seems like a lot of money, but it’s incredible how quickly we go through it every month. Especially now that we have kids and unexpected expenses seem to come up all the time.

Our Monthly Expenses

Being debt free has put us in a unique situation to have a decent cushion in our monthly budget. The average family in America with debt likely spends thousands of dollars on a mortgage or rent, car payments, student loans, and credit cards. Paying off our debt has allowed us to live with lower monthly expenses to spend more on things we enjoy. It also positions us well if we ever have a sudden job loss or other life events. We are beyond blessed to be in the situation we’re in today.

Do you have questions about our monthly expenses? See anything significant that we’re missing?

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

This is very inspiring to see how you are living life after being completely debt free. I appreciate the transparency of all your expenses and income. Keep up the great work!

Thanks, Kyle! I appreciate you reading and commenting.

We kept our cleaning service after DGal retired early last year. We’ve started discussing if we would keep it when I quit my job (whenever that is). It might be one of the items we cut in order to help pay for non-employer sponsored health insurance.

I like your bucketing of costs into the 3 groupings (Necessities, Nice to Have, Luxuries) I have done detailed tracking of our costs, but I have yet to split them into those groupings. I really need to do that some day.

-DGuy

Thanks. When we first started out we tracked every expense no matter how small. It’s what we had to do to create some separation to be able to start paying down debt. Now that we have separation between income and expenses we can be less strict.

This was an interesting exercise to see how much we could live on if we really had to. Thanks for reading!!

I’m super envious of your spending habits! We have a long way to go to get where you are.

Thank you! Trust me, this has been a LONG process to get where we are. We started our journey back in 2011 and have been far from perfect along the way. However, three steps forward and two steps back is still heading in the right direction.

I like well laid out this is!

Very inspiring! Thanks for sharing!