Paying off debt is hard. Not because it requires any type of special skill, but because paying off debt requires a tremendous amount of discipline. Setting realistic goals is important because it allows you to keep focus even when things get tough. Paying off debt is kind of like watching grass grow. If someone were ask you to sit outside and watch the grass grow it would be incredibly easy and boring. However, it would require a lot of discipline to stay focused. Okay, so maybe that wasn’t the best example but you get what I’m saying. Now, if you could trade grass clippings for financial freedom, it might be worth the effort.

From a debt pay down standpoint, 2017 has been our most successful year yet. It has also been the least exciting when it comes to spending money. In the past we’ve almost always spent money on a big ticket item or two that prevented us from aggressively paying down debt. Sometimes the purchases were necessary such as when our HVAC system went out, other times not so much such as buying a wave runner (yes, really), taking a nice vacation, or purchasing a newer used car.

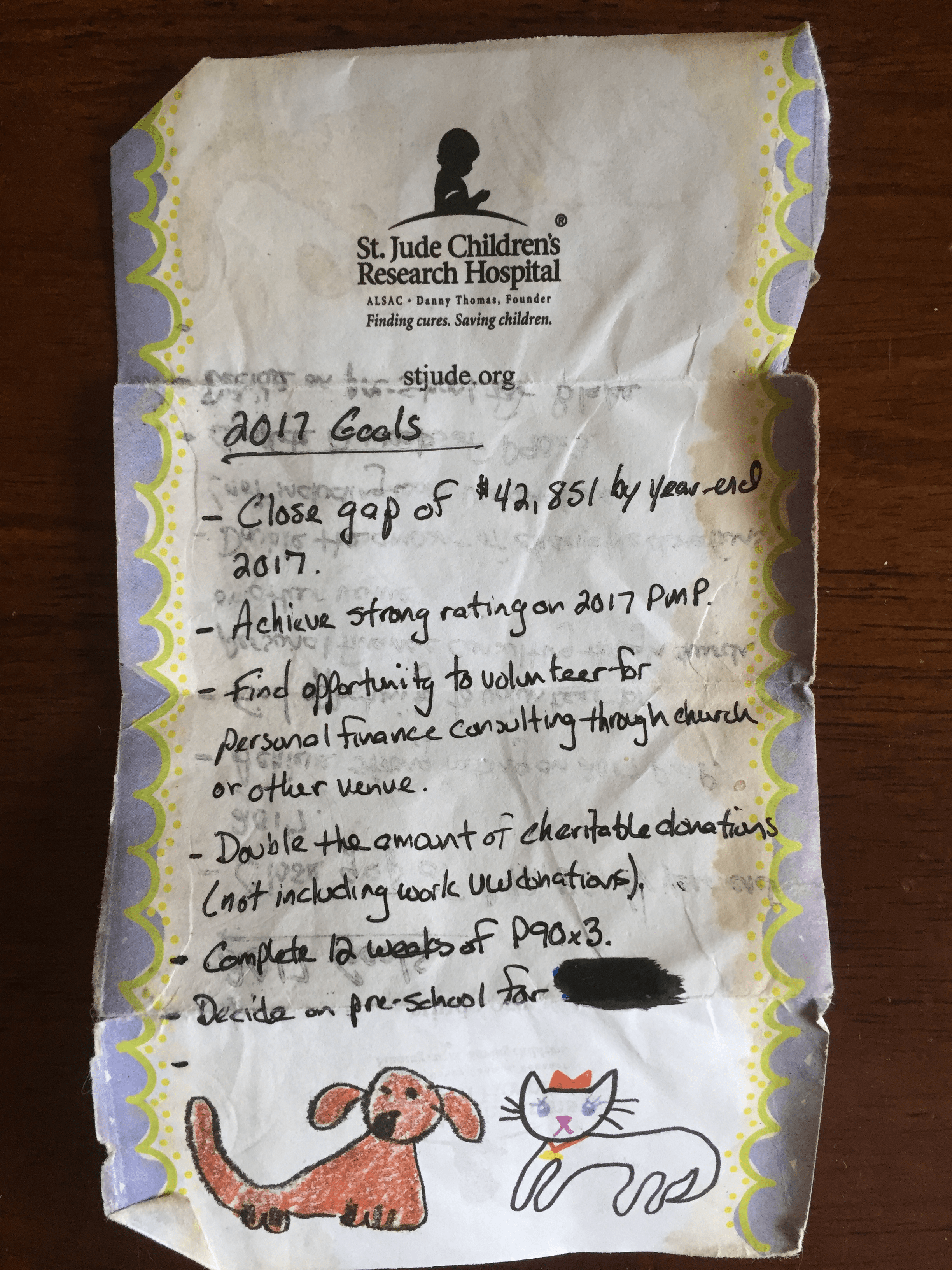

I mentioned in my blog post last week that my wife and I sat down last year and actually wrote down our goals. I believe that goal setting is one of the most important things you can do to achieve success. While we kind of had goals in the past, the process of sitting down and actually writing out our goals made a big difference.

The goals have been in my wallet all year, and have been pulled out several times to review throughout the year. Many successful people will even go a step further and place their goals in a place visible every day. I may do that in 2018. The focus on this blog post will be reviewing our 2017 goals to see how we did.

The goal sheet took a beating from being in my wallet all year

Goal 1: Close gap of $42,851 by year-end 2017

This goal needs a little more explanation. For the past several years our debt pay down goal was to have enough money in savings to pay off the mortgage. It wasn’t until mid-2016 when we decided to commit to paying off the mortgage as opposed to just having the money in savings to cover it. Before then our goals weren’t as focused which often resulted in spending large chunks of money from savings to make purchases that didn’t contribute to our debt pay down goal.

At the beginning of 2017, the balance on our mortgage was $93,041. We also had about $50,000 in savings that had taken years to accumulate. Therefore, the spread between these two numbers was $42,851.

So how did we do this year?

Well, we came really close to hitting this goal but fell a little short. We knew going into the year this would be a really aggressive goal to achieve. The end result is an overall reduction of $36,861 (86 percent of the goal). Even though we fell a bit short, I’m still proud of our progress this year.

In March 2017 we took a huge step in our commitment to pay off the mortgage and moved more than $30,000 from savings to the mortgage. Therefore, with the money from savings combined with debt pay down, our mortgage was reduced by $62,041! The remaining balance on our mortgage heading into 2018 is $31,000. You can probably guess what one of our 2018 goals will be.

Goal 2: Achieve Positive 2017 Performance Review at Work

This goal is related to my career which I don’t write about too much here on the blog. My organization has a typical performance review process where we receive a rating at year end on our overall performance. Doing well in my career is important to me.

I’m happy to report this goal was met this year. I have been off work all this week and have had the chance to reflect on the year. While it was stressful at times, the work is rewarding and I feel like I grew a lot professionally.

I am fortunate to have a job that is challenging, rewarding, pays well, and offers decent work/life balance. The goal of achieving financial independence is not to quit my job. I would love to work at my organization for a long time even if I’m able to achieve financial independence. However, I also know that factors outside of my control could impact my future job security. I never want to be the person whose life is ruined by a layoff. I want to be the person who leaves knowing I’m not going to lose the roof over my head because someone else made a decision that my position wasn’t needed anymore.

Goal 3: Find Opportunity to Volunteer for Personal Finance Consulting

This goal was surprisingly harder to achieve than expected. With an educational background in finance and more than 10 years in the financial services industry, I thought finding a volunteer opportunity of interest would be easy. I will admit that I didn’t put as much effort in to this goal as possible, though at the same time did pursue several opportunities. My end goal with volunteering is to help families who need financial advice, either through my church or other organization.

I have had the opportunity to volunteer this year through organizations such as Junior Achievement and INROADS. Therefore, I would still consider this goal mostly complete. I will continue to look for volunteer opportunities that more closely align with my goals next year.

The volunteer opportunities I’m most interested in become available through relationships. Providing personal finance counseling isn’t something that an organization will let just anyone do. I’m working on building better relationships through my church and other organizations to get more involved.

Goal 4: Double the Amount of Charitable Donations

The goal this year was to increase charitable contributions from about 3 percent of take-home pay to five or six percent. We completed this goal and now give away between 5 and 6 percent of our take-home pay every month. Giving is important to us and at some point it would be great to be successful enough to give away more money than we take home in a year.

Our goal in 2018 will be to increase charitable donations to 10 percent of take home pay. I think everyone should have a goal to give away 10 percent of their income to causes you believe in. This doesn’t have to be related to tithing or any other religious affiliation. I have come across content recently discussing the magic of giving at least 10 percent, and I want to experience that as well. I regret not giving away 10 percent early in my career when it wouldn’t have been much money. Now that we make more money, it would have been a big leap to go from 3 percent to 10 percent this year, which is the reason for the more gradual increase.

Goal 5: Complete 12 weeks of P90x3

Remember several years back when P90x was all the rage? More recently Beachbody came out with the trilogy, P90x3. Without going into details, P90x3 is similar to the original P90x program but shorter. My wife and I successfully completed the 12 week P90x3 program this year. Exercising and eating well, which I’m not always great at, can help to achieve personal and professional goals. I’m a believer that diet and exercise are the best medicine for developing a strong immune system, having more energy, and reducing stress and anxiety.

Goal 6: Find a Preschool for DS3

First of all, DS3 stands for Darling Son, Age 3. It took me a while to figure out this lingo commonly used in internet forums. When we were setting goals, DS was 2 years old and finding the right preschool was a high priority. We ended up enrolling him in the public school system where we live and are happy with the outcome. For those that may be curious, even though its a public school preschool program we are still paying $600 per month. This was much cheaper than some of the private preschools that charged $1,000+ for full day programs. The program he’s enrolled in is as good if not better than other places we researched. Regardless, kids are expensive!

Summary

Overall we did really well this year. Even for the goals we didn’t meet, we came really close. Sitting down and writing out our goals made a huge difference. We ensured our goals were a mix of personal and professional which is important to keep balance in our lives. I’m excited about sitting down to set our 2018 goals and am already thinking to add to the list. Regardless, our goals will be simple enough to fit on a small sheet of paper, yet aggressive and challenging. We have baby number two expected in March 2018 and that alone will make next year fun and exciting.

Thanks to all who have taken time to follow this blog on social media, through WordPress Reader, or by subscribing via email.

How did you do on your 2017 goals? Comment below to share!

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

I agree with you on giving. We always have given over 10% of our gross pay to what we believe in. Although on paper that amounts to over a million dollars in investments and growth I believe it had the opposite effect and enriched us both monetarily and spiritually. Givers are generous by nature, and it is an attribute you acquire through practice. Generous people become kind and thoughtful and are trustworthy and that is rewarded at work and through better relationships all around. I firmly believe that the improvements it makes in your heart are well worth the cost of what you give!

This is such a great comment. Thank you. I know that giving can be a sensitive topic, especially the right amount to give. I have seen enough evidence to believe that the more you give, the more it comes back in different ways.

Call it spiritual or mindset or whatever, there is definitely something magic about giving your money (or time) to causes greater than yourself. I believe Tony Robbins said that giving teaches your brain that there is more than enough to go around, and that abundance mindset can lead to bigger things. I wish that I would have realized this earlier in life.

I have to admit that we didn’t have any specific goals for 2017, but we will have a big one for 2018 (save 50% of our income). We’ve been floating a bit since I paid off my student loans in 2013, so we are turning that around and getting a serious focus back now.

I like the idea of doubling charitable contributions this year – 2017 is the first year I sent any significant amount of money to charities and I’d like to continue to grow that this year.

That is a big goal, good luck! We floated for years as well after paying off student loans, even going back into non-mortgage debt by purchasing two newish cars. I’m looking forward to seeing your progress in 2018!

Frustrating when that happens, isn’t it??

Hello FP!!

Even though you fell short of it, it’s okay. That just means you keep going! I’m very sure you will kill that remaining balance of $31k this year!! Overall, you still did fantastic! 🙂

Now it’s time to look forward to the things you need to accomplish. All your goals here are great. I really hope you nail them all. I am happy to hear you love your job. It’s true though that there’s no job security but being a top performer will increase your chances of them keeping you and even promoting you.

Also, congrats on baby 2. Must be super duper exciting for you to have a new member!!!

Thank you! 2017 was a great year overall. On the job situation, I’ve been reminded so many times lately in various ways that just because things are good now doesn’t mean they always will be. Peace of mind is more valuable than just about anything I could spend my money on. Happy New Year!