As mentioned in my initial post, when we started our journey in 2011 to pay down the nearly $200,000 in debt we had accumulated it started by reading several different personal finance books. One book that had a lot of influence was Dave Ramsey’s “Total Money Makeover”. This book, along the Dave Ramsey Online Course, Financial Peace University, helped change the way we looked at money. Money was no longer for purchasing stuff, but for buying experiences and freedom. Enter Dave Ramsey’s baby steps.

The Dave Ramsey plan is a simplistic, and in some ways extreme, way to pay down debt. Dave caters to the masses, many of whom have little financial literacy. He is an outstanding communicator and does an excellent job getting his message across to a large audience. Overall, I love Dave Ramsey and his message. I am grateful that he helped change our approach with money.

A few of Dave’s general teaching and principles are below. Some we follow closely and others not so much.

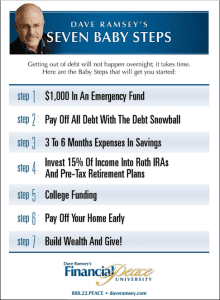

Follow Dave Ramsey’s Baby Steps to Financial Freedom

If you are not familiar with Dave’s “baby steps”, you can click here for a quick overview. The baby steps have basically been our goals for the past several years. When we had seven different student loans totaling nearly $50,000 we paid them off one-by-one using the debt snowball method. Once we paid off the loans and cars, we immediately started saving for the emergency fund. Now, here we are several years later on baby step 6. We are so close yet so far away from getting the mortgage paid down.

Use a Zero-based Budget to Take Control of your Finances

Budgeting is at the core of the Dave Ramsey plan. It’s such an important part that he has developed an app (Every Dollar) to make budgeting easy. Honestly, if we were better at budgeting we’d probably be out of debt right now. We’ve tried budgeting and hate it. It doesn’t work for us.

Instead, we tried to come up with a simplistic alternative to budgeting. Several years back my wife and I sat down and wrote down all of our general expenses minus entertainment and other discretionary expenses such as going out to eat. From there we agreed to a savings rate that we wanted to hit every month (this is now the money we’re using to pay down the mortgage). Therefore, the mortgage gets paid as soon as we do.

Every once in a while we have to make a lower mortgage payment or pull some money out of our fully funded emergency fund, but for the most part we pay ourselves first every month (well, technically, we pay the mortgage first every month). We then pay all of our other bills as soon as possible and spend the rest on whatever we want. We had been doing this for years, and then came across the term “anti-budget” that I believe the blogger/podcaster Paula Pant came up with at affordanything.com. Most of us don’t want to budget, so why not take a much simpler approach?

There is No Good Reason to have a Credit Card

Owning a credit card requires a certain amount of discipline. You probably shouldn’t have one (or many) if you are someone that absolutely cannot control your spending and will be tempted to run up credit card debt. However, I can think of a few very good reasons to have a credit card.

- A strong credit rating is important. Even the most passionate followers of Dave may at some point need to take out a loan (15 year mortgage, of course) to purchase a home. Your credit rating can make a huge difference in your monthly payments. Credit ratings may also be used in hiring decisions when you apply for a job. In my opinion, the complete disregard for credit ratings is the most dangerous omission from Dave’s teachings.

- Have you ever tried to travel without a credit card? It is doable though can be a huge pain. Traveling for work with a debit card can be challenging and you’ll need to be prepared to have a large hold put on your account upon checking into a hotel. Also, reimbursements through your employer can sometimes take weeks to receive.

- The points and rewards can be a nice perk. Dave often says that nobody gets rich on hotel or airline points, though if you are responsible you can get complimentary airfare and hotel rooms. I know there are studies about the psychological aspect of spending more when you have access to credit cards, but if used responsibly I have a hard time passing up free airfare and hotel rooms.

Married Couples Should have Combined Checking Accounts

I get the logic behind this one, but also come from the approach of “if it ain’t broke, don’t fix it”. My wife and I are both pretty independent individuals. I don’t want to be worrying about every $5 cup of coffee or the occasional expensive clothing purchase. As long as she’s not using credit to buy those things, then I think a certain amount of financial independence is perfectly fine within a marriage. My wife and I have yet to have had a serious fight over finances during our more than seven years or marriage. It’s a non issue for us, so why change things up?

We are aligned on our goals and discuss our finances (me much more than her). Ground rules are in place such as not accumulating credit card debt that can’t be paid off at the end of the month. Also, we discuss any purchases of roughly $250 or more. Additionally, the anti-budget approach gives us both some money to can spend without being tied to a budget or asking permission from each other.

Giving is One of the Most Important and Rewarding Aspects

I could not agree more with this statement. As pay down debt we make a point to give a certain amount of our income to charitable causes. The amount we give now isn’t as high as we’d like. We plan to at least double our contributions as soon as we reach baby step 7. There are so many worthwhile causes to give to in the world and I can’t wait to be able to give more. There is little in life that is more fulfilling than helping a person or cause genuinely in need. One of the reasons I am passionate about pursing financial freedom is not to be able to quit a job but to be able to give more. Baby Step 7 is all about turning from aggressively paying down debt to investing and giving. I am very excited about both.

Summary of the Dave Ramsey Online Course

I love the overall concepts that Dave teaches. It just so happens I’ve highlighted a few things we have done differently in the pursuit of financial freedom. Personal finance is a little like dieting or working out. There is so much conflicting and restrictive information out there that it can be paralyzing. If you have some level of financial literacy and discipline you should be able to take the Dave Ramsey’s baby steps and make them your own.

Thanks for reading!

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

I agree with you. Me and my wife do the same. Although we do have a combined checking account we both put money into monthly to pay our bills etc, we also have our own independent finances and it works great. Other than that, Dave Ramsey’s plan is spot on. It’s helped me get in control over my own finances. Currently on babystep 4, 5 and 6 here 🙂

Thanks for your comment! It’s amazing what Dave has been able to do to make paying off debt go mainstream. He has improved the lives of so many. Best of luck as you move through the remaining baby steps!

I know. It really is amazing. I know quite a few people who follow his steps over here in the UK too. Goes to show how bulletproof his method is when it even works in different economies.

And yourself 🙂 I wish you all the best. I’ve followed your blog and look forward to following your journey!

Andrew.

“Nobody gets rich on hotel or airline points.” I would argue with this one. If you’re someone who does a ton of travel (like we do), paying for trips with rewards points and investing that money instead can be a serious boost on the way to growing wealth.

We also have kept our finances somewhat separate 🙂

Thanks for your comment. I used to travel more for work a few years back and couldn’t imagine leaving the points on the table. We took several low cost vacations as a result. I know that some people can’t handle the temptation of a credit card, but for a lot of us it’s a great perk. Especially if you travel occasionally for work.

I love this post! When I first stated out, Dave Ramsey was my go to man! But I couldn’t pass up those travel rewards! Lol. Checkout my latest post that is similar titled No Vacations? No thanks, Dave Ramsey!

http://www.peerlessmoneymentor.com/no-vacations-no-thanks-dave-ramsey/

Thank! I will check out your post. Dave’s advice is really good all around. Vacations and travel rewards is an area where I disagree as well. Reasonable vacations can help keep someone motivated and can even be a reward for paying off some debt.