Compound interest may be the most potent personal finance-related topic out there. By combining time and money, a little bit today can be worth much more tomorrow. Most of us have heard about compound interest, but for me, when I sit down and run through the numbers, the power of compound interest blows my mind. In this post, we will look at a few examples that stress the importance of starting early, even early. For example, what if these compound interest examples were taken to the extreme and we started investing for retirement at birth? Let’s take a look.

Compound Interest Examples from Bill, Susan, and Chris

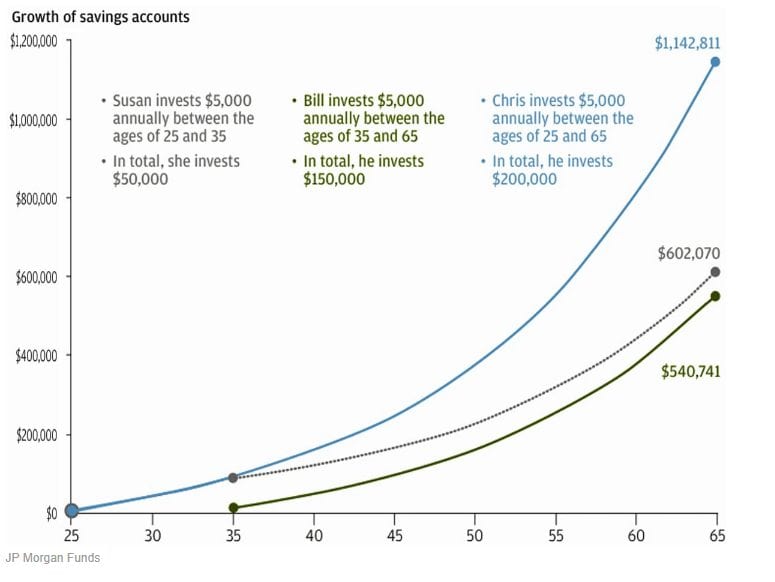

Before we get into the power of investing as a baby, let’s look at a few more realistic compound interest examples. The three individuals below are all in different stages of life.

- Susan is a college professor who invests $5,000 per year in a stock-heavy retirement account for 10 years total between the ages of 25 and 35. In total, she invests $50,000 during this period. After age 35, Susan begins investing in other assets and does not add additional money to her retirement account.

- Bill is a dietician who also invests $5,000 per year in an account similar to Susan’s but has done so over 30 years. Unlike Susan, Bill got a late start on investing and didn’t begin until age 35. He invested $150,000 total until the age of 65-years-old.

- Chris is a lab technician who gets the best of both worlds by investing his $5,000 over the full 40-year period, beginning at age 25 and stopping at 65. In total, Chris invests $200,000.

Who do you think will end up with the most money? Chris will consider that he has the best of both worlds. But what about Susan and Bill?

The chart assumes 7% growth rate. Source: business insider via jpmorgan.com

The main takeaway from the chart is Susan ($602,070) ends up with more money than Bill ($540,741) even though she only invests for a period of 10 years while he invests for 30 years. They invest the same amount of money annually yet the difference is Susan starts investing at the age of 25 (and then stops after 10 years) and Bill starts at the age of 35 and invests until retirement. So, Susan’s ten years of investing beats Bill’s 30 years since she started at 25 and Bill started at 35.

This is an oversimplified example. In real life, investments would likely change yearly, hopefully increasing over time. The interest rate of 7% would fluctuate annually, especially with a portfolio heavily invested in stocks. However, the point here is to observe the power of compound interest over time.

Think about that for a minute. This is a huge difference. Bill has to invest TWENTY more years than Susan with his late start, and he will still have less money at retirement.

What if You Started Investing as a Baby?

I have seen dozens of compound interest examples similar to the one associated with the above graph. However, I’ve seen very few that recommend saving for retirement even earlier. After additional research, the Google machine returned a few articles focused on starting investing as a baby, though similar content is rare.

Therefore, let’s add someone else, along with Susan, Bill, and Chris. Let’s say Johnny was born in the year 2021.

When Johnny was born, someone in his family made ONE $5,000 lump sum payment into a retirement account. For consistency, assume a growth rate of 7% and a retirement age of 65.

By making ONE payment of $5,000 when Johnny is just a tiny baby, he would have nearly $500,000 at the age of 65. Multiply that initial investment by 2, and you could have a future millionaire. Little Johnny’s money would be worth 100 times just by placing it in an account and letting it sit there, making an annual return of 7 percent.

To reiterate, Bill would have to make 30 payments of $5,000 starting at age 35 to have roughly the same amount as baby Johnny’s ONE payment.

I get it that this example doesn’t factor in inflation. For example, the purchasing power of $5,000 in the year 1986 (35 years earlier) would have been $1,946. That said, this still demonstrates the incredible power of compound interest. Even an investment of $1,946 would be worth nearly $200,000 at age 65.

Compound Interest Examples Thoughts

So what is the cost of making your baby a future millionaire? The answer is $10,000. Of course, due to inflation a million dollars 65 years from now won’t be nearly as valuable as a million dollars today. However, it’s still an interesting thought exercise to go through.

Why isn’t compound interest discussed more broadly? Primarily investing even before entering the workforce. Well, I’m not sure, but I can speculate.

- Babies don’t read Business Insider articles (or personal finance articles in general). Therefore, the audience for personal finance articles is usually adults, anywhere from recent college graduates to retirees.

- It’s weird to think about your newborn baby getting to retirement age. It just is.

- Similarly, 65 years is a really long time away, and most parents only have financial responsibility for their children through college.

- Most parents won’t live to see their children turn 65. Nobody wants to think about that.

To summarize, if you have a few thousand dollars lying around and a child on the way, consider throwing that money into a brokerage account and letting it grow until your little bundle of joy reaches retirement age. I know that most people don’t have that kind of money available, but that wasn’t the point of this blog post.

The purpose was to show a few compound interest examples and how important it is to start investing in retirement early, whether at age 1 or 25. If a person takes only one thing away from the personal finance world, it should be an understanding of compound interest. It is so powerful!

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

$5,000 —> $500,000 is a staggering return. It really is remarkable how much it grows over time.

You can basically buy a little peace-of-mind for your kid early in life, giving them the comfort to know that a pretty big chunk of his/her retirement is taken care of. And for a relatively small initial investment.

Who knows, it could free just enough paycheck cash flow up for your kid later on in life to pursue that business he/she has always wanted to get off the ground. And they may just have the guts to do it, knowing they have a cushion growing bigger and bigger all by itself in the background. It’s super fun to think about all the possibilities a couple grand now could grow into.

Thanks for the reminder how important saving and investing for my son is right now!

And that is with a relatively conservative rate of return! Compound interest is pretty amazing. Thanks for your comment!

I love this post. I keep telling my husband that the day our now toddler daughter earns her very first paycheck, hopefully in her early teens, if we are equipped to do so, we will plop one lump sum into an IRA for her. Somewhere between $1000-5000 would be great. A lot of people don’t realize that if you have worked so much as a single day in your life you are eligible for an IRA (i.e. a toddler that does a photo shoot for a baby catalog). Stay at home parents can and should have an IRA of their own, separate from their working spouse too 🙂 Great post about compound interest!

Bingo. “Educated parents with some extra money could.” One of a myriad of motivations for getting our own financial act together, so that we are better equipped to set our kids up well, not just with tangible money but with the head knowledge early on to understand financial planning.

Great tip. I’m not sure if I’ve thought far enough ahead about the considerations of an IRA for a teen worker. Thank you for sharing!

I wonder how much Bill would have to contribute from 35-45 to beat Susan. Chances are, at that age, he would be able to contribute more.

I like these calculations, but I also think it is also worth noting that someone who starts heavy at 35 still has 30 years to see their money grow. Also looking at how much more someone has to contribute in their 40’s to make up that lost time would be interesting. What if Bill, for example, could contribute $20k/year starting at 35?

I’m definitely biased, because I am starting late, but I think some people could look at these numbers and decide “well crap, I missed the boat, I’m screwed”. I know that isn’t what you are trying to do with this article, and I wish I got my finances together when I was in my early 20’s. But the best I can do is utilize the time I have left and save as much as possible and increase my income. 🙂

Great questions! I totally get it that this information could be frustrating for late starters without time on their side. The good news is that it’s never too late to get started.

To answer your question, if Bill were to invest between 35 to 45 and then coast to retirement until 65 he’d need to invest about double annually compared to Susan. So in this case it would be a little more than $10,000 per year. To your point, the 35-45 age range tends to be prime income earning years so there is still plenty of time to catch up.

Even though I started investing in my mid-20s, it could have been so much more and I missed out on a great bull run. Looking backwards isn’t at all productive so all we can do is keep focusing on what’s ahead. You are doing great and with your mindset you will be in a great financial position well before retirement.

I have a few k in I bonds for my son aside from his college 529. I am starting to wonder if I should put that cash in a brokerage account for him….

Probably depends on what you plan to use it for. We have money in a 529 account. I find that it’s much easier for relatives to contribute to a 529 compared to a regular brokerage account.

Your family is better and then mine in that regard, that money we have to deposit. The kicker is if they did it they get a tax deduction for doing it. This is really just the birth money that he got. It’s a family tradition to give a little bit of money at the birth of a child but I have a big family and it adds up. In the case of my sister and I in ended up becoming Money to help us with college expenses .

Such a great article! The difference we can make in our kids lives just by putting away small amounts now can be absolutely staggering later.

We use individual cash brokerage accounts for our boys in tandem with the Canadian RESP (registered education account) tax deferred investing accounts.

The day the boys start working the first jobs (no matter how small the income) we’ll be making sure they file tax returns which will allow them to initiate the accumulation of room in an tax deferred RRSP (registered retirement account), and then max out the contribution room immediately for all the reasons you have so compellingly highlighted in this post!

Phia, those are such great suggestions! We do a few things to help our kids save even at a young age but need to start thinking about more advanced topics such as this. Thanks for commenting!

Hey, great post. Saving money from an early age can benefit from this situation. I always suggest my kids to build a habit of saving money from an early age. Thanks for sharing such an informative post.