How many of us have thought to ourselves, “If I only had a million dollars all of my financial troubles would go away…”?

I know I have.

A million dollars is a tricky amount of money to think about. While it can be life-changing money, it’s probably not life-changing enough to live off for the rest of our lives without some work. The reality is that if most people received one million dollars, half of the money would be gone to taxes, a few hundred thousand dollars to pay off debt, and the rest spent on expensive cars, vacations, etc.

I remember being five years old and even $5 seemed like one million dollars at the time. As little as $1,000 seemed like a million dollars when I was a teenager. Now that I’m older, one million dollars doesn’t quite seem like one million dollars (if that makes sense).

For the sake of simplicity, we’re going to assume this one million dollar windfall is tax-free. Now the question: What should we do with the money? The easy and boring answer is to put the money in a brokerage account, invest it in something safe, and apply the four percent rule. The four percent rule is a rule of thumb used to determine the number of funds to withdraw from a retirement account each year while limiting the chances of running out of money (thanks, Investopedia). This would provide you with $40,000 of income per year without lifting a finger.

For the purpose of this article, let’s think through the options a little more. Instead of dropping the money in a low-risk index fund, let’s invest in something more interesting such as buy-and-hold real estate.

Our One Million Dollar Windfall

One Million Dollars Remaining…

First, 10% of the one million dollar windfall would go to charitable causes, so there goes $100,000 right off the top. It’s easy to give away six figures of virtual money, and I hope we’d have the discipline to do the same if this situation ever occurred. The majority of this money would go to causes and organizations where we already contribute. However, we’d use a good chunk of it to give freely when the occasion called for it.

We could pay for the meal of the table next to us at dinner, buy groceries for the family behind us at the store, or make a donation to the gofundme page of someone who is truly in need. I personally get a lot of satisfaction from helping others and we would have fun with giving away this money. In fact, I think the financial independence community could make a huge impact on the world with a bit more generosity.

$900,000 remaining…

Next, $200,000 would go into trust accounts for my two young children under the age of five. Giving each of them $100,000 would be good starter money to buy a home, start a business, or pay for college. However, not too much money that it would make them feel entitled.

$700,000 remaining…

I would give my parents $100,000 to use on whatever they want. My parents are pretty awesome people and this would be a good way to say thanks for all they have done for me. They started investing in retirement later in life so they could use a little help with their retirement. They are in better shape than most approaching retirement age through a combination of retirement funds and money left by my grandparents. An extra $100,000 would help them pay off some remaining debt, add money to their retirement portfolio, and maybe go on a nice vacation.

$600,000 remaining…

An additional $100,000 would go into emergency savings. Since we are completely debt-free including our mortgage, we won’t have to pay down any significant debt. Having an emergency cushion of $100,000 would cover two to three years of living expenses in a worst-case scenario situation.

$500,000 remaining…

Okay, so here is the fun part. We’ll take the remaining $500,000 to start a buy-and-hold real estate business.

We will set aside $100,000 to pay for the initial set up of the business and emergency reserves. That will leave $400,000 to purchase buy and hold rental property.

For simplicity, we’ll be purchasing these properties all cash in my home city of St. Louis, Missouri. After extensive research, networking, and negotiating let’s hypothetically say we were able to obtain the following properties:

- A 4-plex with a purchase price of $120,000 in South St. Louis City (C+ class neighborhood). The property costs an additional $40,000 to upgrade and get rent ready. Gross rents for the 4-plex (all one-bedroom) are $500 per door or $2,000 total.

- A turn-key duplex with a purchase price of $140,000 in an up-and-coming neighborhood in South St. Louis County (B class neighborhood). The property is rent-ready upon purchase and each side (two bedrooms) rents for $750 per door or $1,500 total.

- A single-family three-bedroom property in North St. Louis County (C class neighborhood) for $55,000. The property costs an additional $15,000 to upgrade and get rent ready. The gross rent for the single-family property is $850 per month.

In total, we have spent $370,000 of our $400,000. We’ll put the rest back into our emergency fund which can be used for a future purchase.

Our gross rent for all properties will be an estimated $4,350 per month. We will assume that 50 percent of the gross rent will be put aside for expenses such as maintenance, vacancies, capital expenditures, property taxes, and property management. This will leave us with $2,175 in cash flow per month to start out.

Like most investments, real estate is playing the slow game. The first few properties may not lead to a substantial cash flow. However, over time there will be compounded gains by putting the cash flow back into the business to invest in more properties. Leveraging rental properties by taking out a mortgage can further accelerate these gains if you are comfortable with the additional risk involved.

Real Estate Investment Analysis

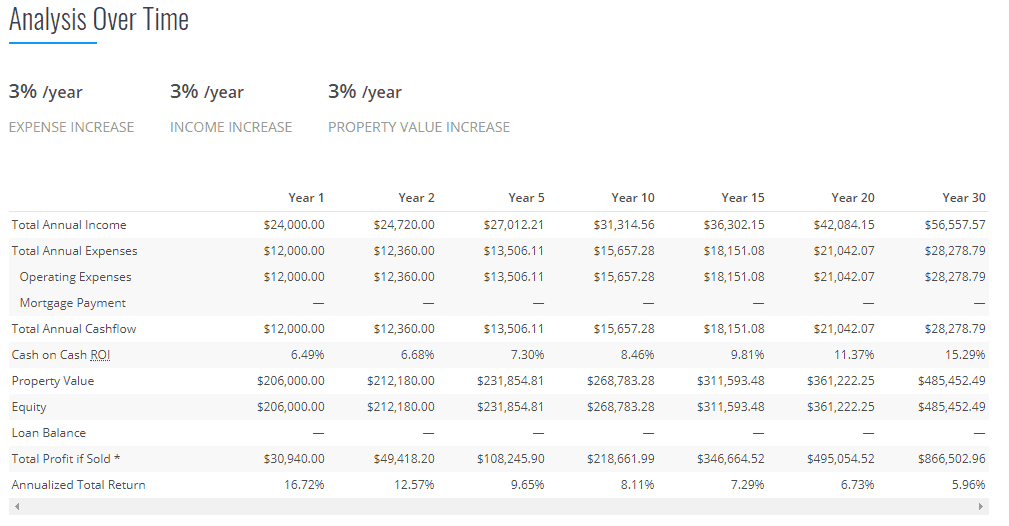

Let’s take a quick look at a breakdown of the 4-plex. For the sake of simplicity, let’s assume that expenses, income, and property values increase around three percent, which is close to the rate of inflation. Using the BiggerPockets Rental Property Calculator we can see the estimated increases in property value and cash flow during several periods within the next 30 years.

Figure 1: Analysis of 4-plex Rental Property over 30 Years

This one property alone has the potential to profit nearly one million dollars over 30 years. The purchasing power of one million dollars will be far less in 30 years than it is today. However, this is just one property. Imagine if the cash flow from our three properties purchased with our imaginary one million dollar windfall was used to purchase additional properties every year. It may take two or three years to save up enough money to purchase property number 4. Though by year 10, we may have enough cash flow to purchase three properties a year or more. Imagine the cash flow and equity that would develop over time!

Many of you may have heard of the debt snowball (credit: Dave Ramsey). Well, the snowball approach works for investments as well. Starting small with a few rental properties can lead to big gains down the road.

Closing Thoughts: One Million Dollar Windfall

Spending pretend money is easy. We just purchased three pretend cash flowing real estate properties in this blog post without doing any work. We also gave away a few hundred thousand dollars to my parents, children, and causes greater than ourselves. The reality is that these things are hard work. It’s hard to find great or even good real estate deals in a hot market. It can be challenging to give money away when the temptation of buying a bigger house or Tesla is present. If I was ever fortunate enough to come across a one million dollar windfall, I hope I would have the discipline to follow through with this approach. After all, personal finance is mostly about discipline anyway.

To summarize, about half of the one million dollar windfall would go to giving and saving with the other half to investing in buy-and-hold cash flow producing real estate. The investing will hopefully produce many more millions of dollars over and over again. That in turn will allow us to give even more to my parents, children, and causes greater than ourselves.

This was a fun exercise to go through as we are strongly considering investing in rental properties as our next big purchase. This year (2019) will be spent rebuilding our emergency fund and starting to save for a rental property. We are leaning towards saving long enough to make an all-cash purchase but would consider taking out a loan for a great deal.

If you enjoyed this article please consider sharing your email address to receive future updates. We promise to never spam. This allows you to receive more content like this post. Thank you for reading!

Mark is the founder of Financial Pilgrimage, a blog dedicated to helping young families pay down debt and live financially free. Mark has a Bachelor’s degree in financial management and a Master’s degree in economics and finance. He is a husband of one and father of two and calls St. Louis, MO, home. He also loves playing in old man baseball leagues, working out, and being anywhere near the water. Mark has been featured in Yahoo! Finance, NerdWallet, and the Plutus Awards Showcase.

I agree! That would have made for a short and boring article though. Was fun to think through this scenario.

Great post, love your conclusion: “After all, personal financial is mostly about discipline anyway.” – personal finance can appear so boring and slow in the short run, yet so impactful and important in the long run! Love the idea of acquiring assets with ongoing cash-flow.

So true! Personal finance is the easiest, hardest thing to do. The concepts are easy, the doing is hard (and slow).

I would be able to do nothing because the RV will never happen in my lifetime.

I like the approach, buying a self sustaining income stream is a great use of a windfall.

I’m a big fan of property investing. I challenge your selections a little, as there is a lot to the “location, location” mantra. Cash flow from property is important to sustain it as a business, but in my experience the real money is made via capital growth. Unless the C class properties were in a neighbourhood that is gentrifying, or offered the ability to create significant capital value (i.e. extend, subdivide, rezone, etc) I’d aim a bit more up market… ensuring the numbers still work of course! The hassle factor as a landlord multiplies by the door, so fewer better properties makes for less sleepless nights than a greater number of lower quality ones.

Well done on providing for your family and causes you feel strongly about, is a good balance.

Great advice. Thanks for sharing! I’m selling these make-believe properties immediately! 😉

Seriously though, you make really good points about the types of properties. Higher market properties may have less competition as well since they require more capital. In a market like St. Louis, even a B+ class property would come at a fraction of the price of something similar on the coast. The appreciation potential is also more limited though.

We did inherit a tax free million a few years ago. Went straight into brokerage accounts. Boring yes, but the last thing I want to do is manage real estate and we were already FI. We gave $10k to each of our three kids, but they will have to wait on their own seven figure inheritances. Hopefully they’ll already be FI by then like we were. Handing an ever increasing family legacy down will be a continuing tradition for our family.

Wow, that’s amazing! Leaving a legacy for my family is one of the most important things for me as well. If this were to actually happen, I may just put the money in a brokerage account as well.

I love that giving is the first part action-step! I agree, I believe that generosity and philanthropy have an important role in our personal lives – even as we’re on the journey to FI and haven’t arrived yet – as well as the world around us, that whole “love your neighbor as yourself” bit. I am curious though about what you’d do with the last $500K – the whole bit into real estate? No stock investments? Curious about that decision, assuming you just like real estate!

Great question, Dan. I should have addressed this in the post. The primary reason for no stocks is because in my situation I already have a decent amount of money tied up in the market in retirement accounts. I definitely don’t have anything against stock investing. In fact for most of us that’s probably the best way to go. Thanks for commenting!

that makes sense!